Will KAVA Price Rally Due to Upcoming Upgrade?

[ad_1]

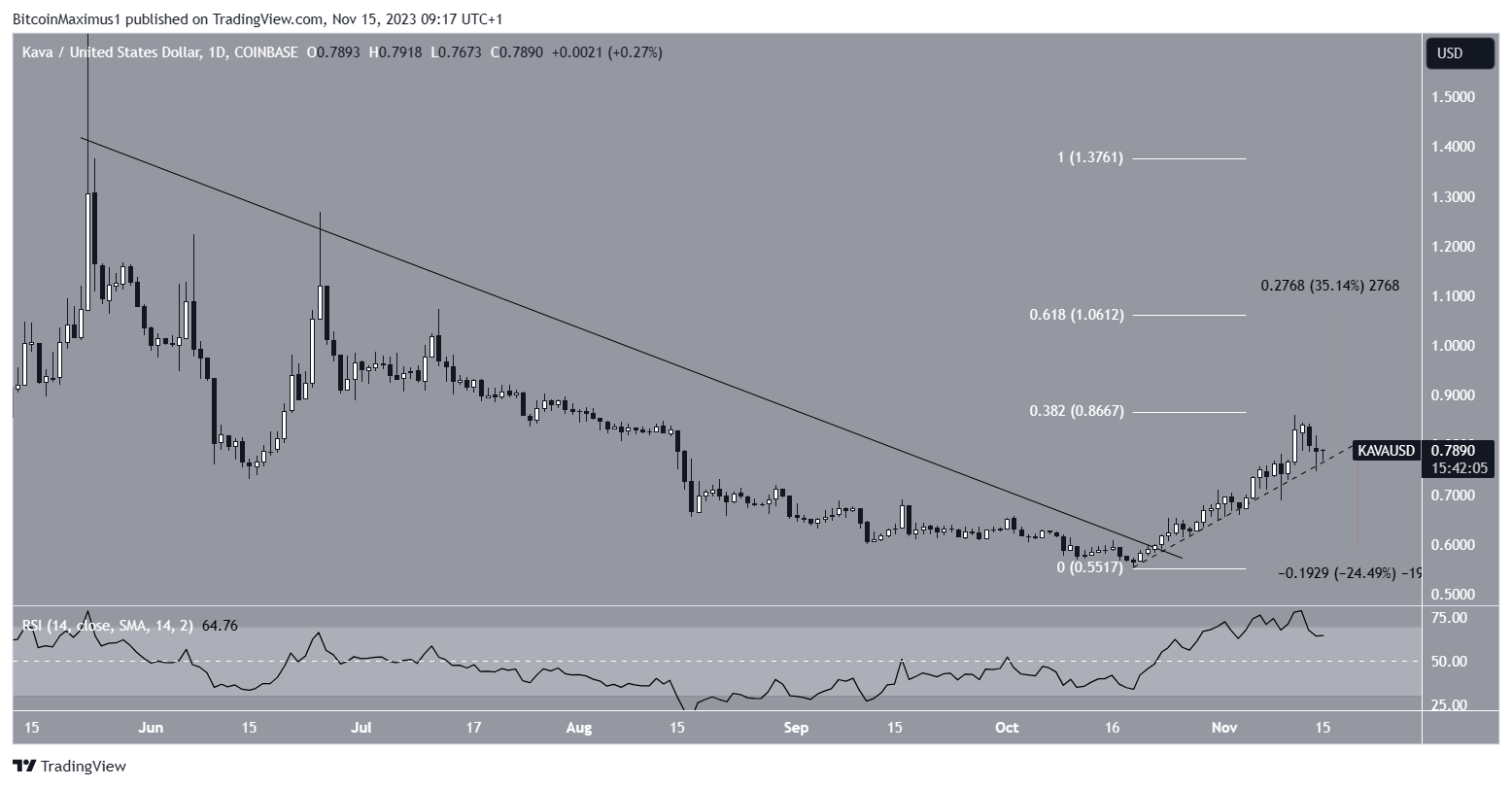

The KAVA price has increased since October, creating a higher low relative to the price at the beginning of the year.

The increase caused a breakout from a descending resistance trend line but failed to clear a Fib resistance level.

KAVA Increases After Higher Low

The weekly timeframe technical analysis shows that the KAVA price has increased since the start of the year.

While the increase culminated with a high of $1.55 in May, the price could not break out from the $1.10 resistance area. Rather, it created a long upper wick and has fallen since.

The decrease culminated with a low of $0.55 in October. The value of the low was interesting since it created a higher low (green icons) relative to the price at the start of the year.

The KAVA price has created four successive bullish weekly candlesticks since then.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The weekly RSI is right at the 50-line, indicating an undetermined trend.

A much-awaited positive announcement dropped this week when the KAVA team announced that Kava v.15.0 is set to launch on December 7.

Read More: 9 Best Crypto Demo Accounts For Trading

What Are the Analysts Saying?

Cryptocurrency trader Cryptoknight890 said that the KAVA price is likely to increase to $1 due to the breakout from its long-term resistance.

Muneeb gave a similarly bullish outlook, noting the reclaim of a horizontal resistance area as a catalyst for an upward movement.

DetectiveCatz is also bullish on KAVA. However, instead of the price action, he believes the Kava 15 upgrade can cause a price increase. He stated that:

$KAVA 15 is set to launch on December 7th Previous upgrades caused $KAVA to experience a pump. I’ve been monitoring it for quite some time, when the price was $0.6x, and during $WAVES pumping. With many coins built on Cosmos recently experiencing random pumps, such as $BLZ $OSMO $SCRT $IRIS $RUNE and $INJ most of them are pumping hard.

KAVA Price Prediction: How Long Will Increase Continue?

The daily timeframe chart shows that the KAVA price catalyzed the increase by breaking out from a descending resistance trend line. Such breakouts often indicate that the previous trend has ended and a new one has begun in the other direction.

Since the breakout, the altcoin has followed an extremely steep ascending support trend line (dashed). While doing so, the price reached the $0.87 resistance area but did not break out. The 0.382 Fib retracement resistance level creates the area.

The daily RSI is increasing and is above 50, both considered signs of a bullish trend. While the indicator is overbought, it has not generated any bearish divergence yet, which would indicate an impending decrease.

So, if the altcoin breaks out above $0.87, it can increase by 35% and reach the 0.618 Fib resistance at $1.06.

Despite this bullish KAVA price prediction, a breakdown from the ascending support trend line will invalidate the ongoing increase. KAVA can fall by 25% and reach the $0.60 support area in that case.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link