VanEck to Donate ETF 10% Profit to Ethereum Protocol Guild

[ad_1]

Asset management VanEck will donate 10% of the profit from its Ethereum Futures ETF to the network’s Protocol Guild for at least 10 years. The revelation is coming on the heels of the expectation that the market will be inundated with several futures ETFs by next week.

In a September 29 statement, VanEck said it would donate 10% of its profit to Ethereum’s protocol guild for at least 10 years.

VanEck’s 10% Donation

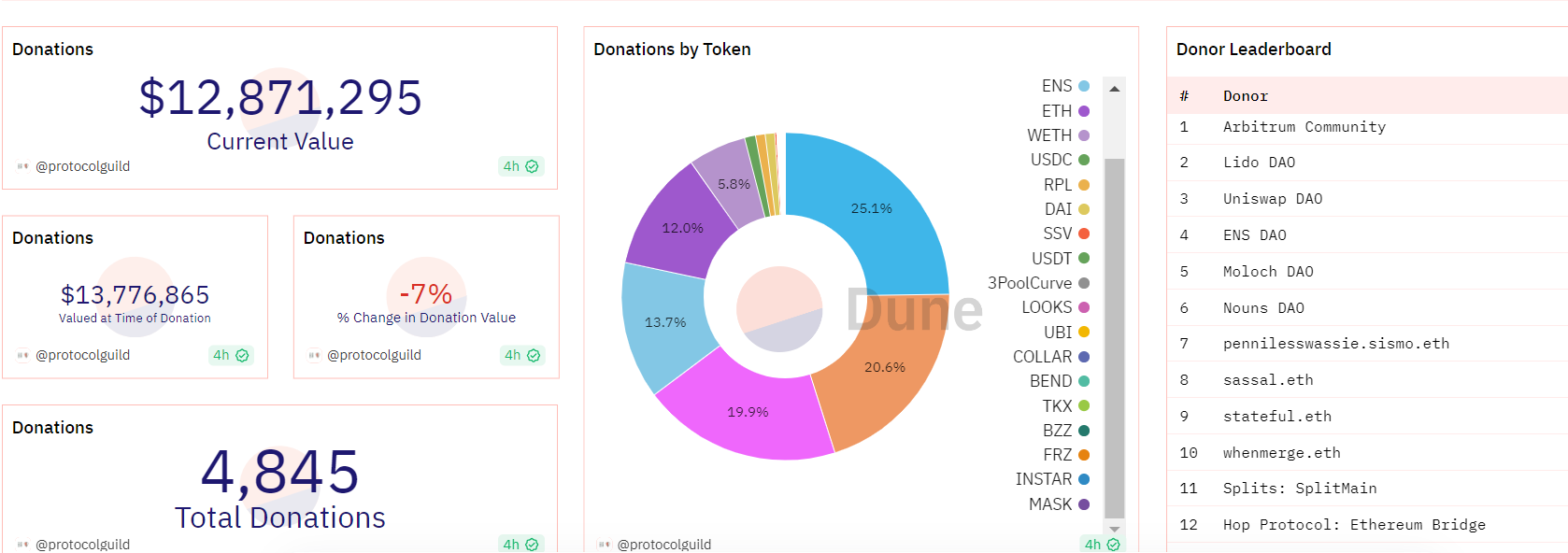

The protocol guild is a 152-member group of Ethereum’s core protocol contributors enabling distributed funding for distributed systems.

According to VanEck, the donation is to appreciate the group’s stewardship towards building and maintaining the infrastructure for nearly a decade.

The asset management firm described the developers as major contributors to Ethereum’s recent Merge and Shanghai upgrades.

VanEck’s donation comes amid its plan to launch an Ethereum Futures ETF product next week. While the fund is already effective, the investment company said it is not yet available for trading.

Though the company noted that it wasn’t sure the fund would commence trading, it promised to provide more details soon.

Through the donation, VanEck will join platforms like Arbitrum, Lido, and Uniswap, which are top donors to the group.

Marketing Gimmick?

Bloomberg analyst James Seyfarrt said VanEck’s donation offer will begin a marketing war between the Ethereum Future ETFs expected to begin operations soon.

Earlier in the week, VanEck had released a TV commercial centered around its Ethereum Strategy ETF. The advert urged viewers to “Enter the Ether” and that its ETF was “coming soon.”

Meanwhile, market observers noted that the adverts signify that the U.S. Securities and Exchanges Commission (SEC) was set to approve an Ether futures ETF before the government shutdown. Bloomberg senior ETF Analyst Eric Balchunas corroborated this view, positing that:

“The SEC wants to accelerate the launch of Ether futures ETFs (because they want it off their plate before [the government] shutdown).”

While Bitcoin spot ETF applications remain in limbo, Ethereum futures ETFs are gaining traction and recognition from investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link