Why Former Binance CEO Changpeng Zhao Can’t Leave the US

[ad_1]

A federal judge in Seattle ruled on Monday that Changpeng Zhao, the former CEO of Binance, must remain in the United States.

This decision follows Zhao’s guilty plea to charges of violating US anti-money laundering laws. Zhao is now caught in a legal predicament that could have far-reaching implications for the crypto industry.

Former Binance CEO Changpeng Zhao Cannot Leave the US

Changpeng Zhao, a citizen of both Canada and the United Arab Emirates (UAE), is required to stay in the US until the Seattle court decides whether he should remain in the country through his sentencing in February 2024. US District Judge Richard Jones is set to review this matter, especially after the US government appealed an earlier decision allowing Zhao’s return to the UAE.

“Having considered the briefing, and the files and pleadings herein, the Court determines it will review the decision of Magistrate Judge Brian A. Tsuchida permitting Defendant to return to the United Arab Emirates pending sentencing pursuant to the conditions of his appearance bond. It is ordered that the condition permitting Defendant to return to the UAE pending sentencing is stayed until such time as this Court resolves the Government’s motion for review,” read the court filing.

Last week, the case took a dramatic turn when Zhao agreed to a $175 million bond as part of his bail arrangement. His resignation as CEO of Binance came amidst these legal challenges.

Binance, the company, also agreed to pay over $4.3 billion in a settlement. Subsequently, pleading guilty to breaking US anti-money laundering and sanctions laws.

“I made mistakes, and I must take responsibility,” Zhao said.

Facing a maximum prison sentence of 10 years, Zhao agreed not to appeal any sentence of up to 18 months. As the Justice Department spokesperson noted, the prosecution’s stance on Zhao’s jail time will be decided closer to his sentencing.

Read more: 7 Best Binance Alternatives in 2023

Despite Binance’s legal troubles, the crypto market has shown resilience. Bitcoin and Ethereum closed the week slightly up despite initial outflows exceeding $1 billion from the Binance. Although the market depth for top traded instruments on Binance dropped by about 25%, it quickly recovered.

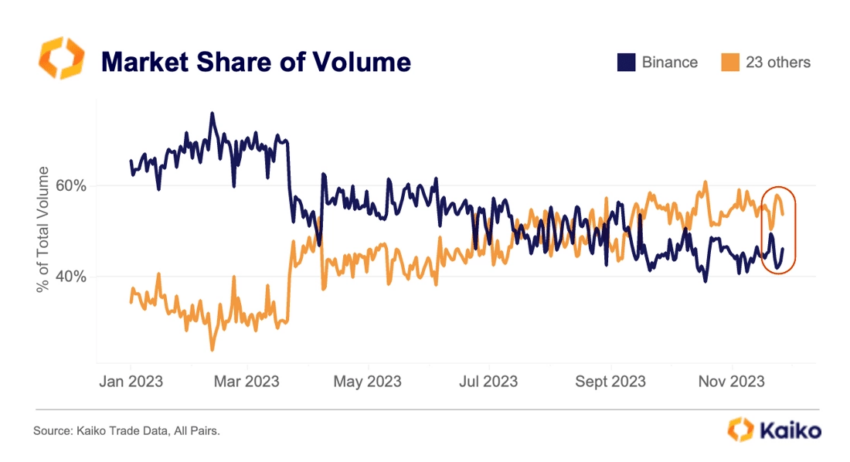

However, Binance’s market share tells a different story. From commanding over 70% at the start of 2023, its market share has dwindled to 46%.

The settlement and the ensuing changes have led to fluctuations in Binance’s native BNB token and trading volumes. Still, “Binance emerged mostly intact save for a large fine, the loss of its CEO, and ongoing monitoring,” said researchers at Kaiko.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link