Why Chainlink (LINK) Outperformed Bitcoin, Ethereum & More

[ad_1]

Chainlink’s LINK token performed better than the top 20 cryptocurrencies in the last seven days, as the digital asset gained 14%. Its price performance is remarkable, considering other major cryptocurrencies’ prices performed poorly during the same period.

Commencing the week at $6.09, LINK peaked at $7.21 earlier today before dropping to $7.12 as of press time.

Chainlink (LINK) Price Outperforms

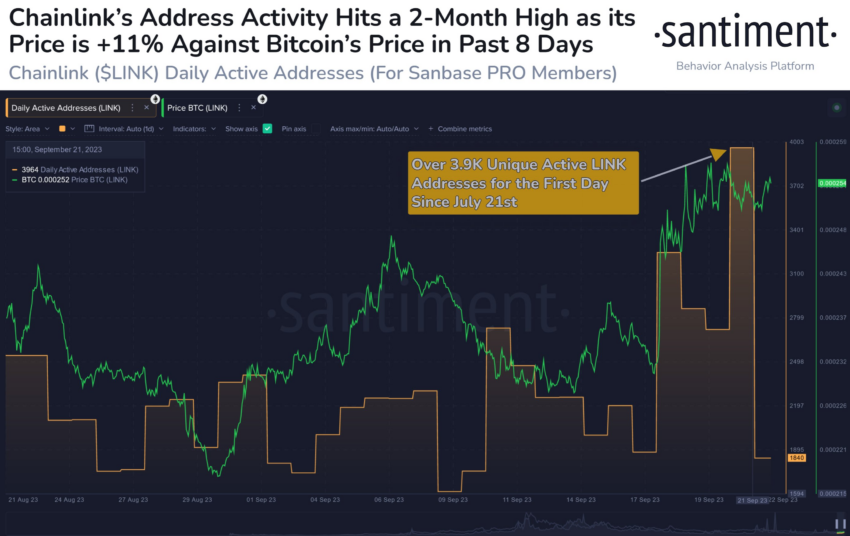

The primary catalyst behind LINK’s robust performance is the heightened network activity within the Chainlink ecosystem. The network address activity hit a 2-month high on September 21 as nearly 4,000 unique addresses interacted with it.

This surge in network activity can be attributed to the increasing adoption of the Cross-Chain Interoperability Protocol (CCIP) by DeFi developers and traditional financial institutions.

Furthermore, Chainlink’s recent collaboration with Swift, a major interbank messaging infrastructure provider, resulted in a successful tokenization test involving prominent global banks. As financial institutions increasingly embrace tokenization, Chainlink’s adoption and utility are poised for substantial growth.

Despite its impressive performance in the past week, LINK remains 86% below its all-time high of $52.

Top 20 Cryptocurrencies Remain Flat

While LINK’s exceptional price performance stands out, the generally muted levels of the crypto market allowed the Oracle token to shine. Among the top 20 cryptocurrencies by market cap, only Solana’s SOL and Ripple’s XRP recorded an increase of more than 2% during the previous week.

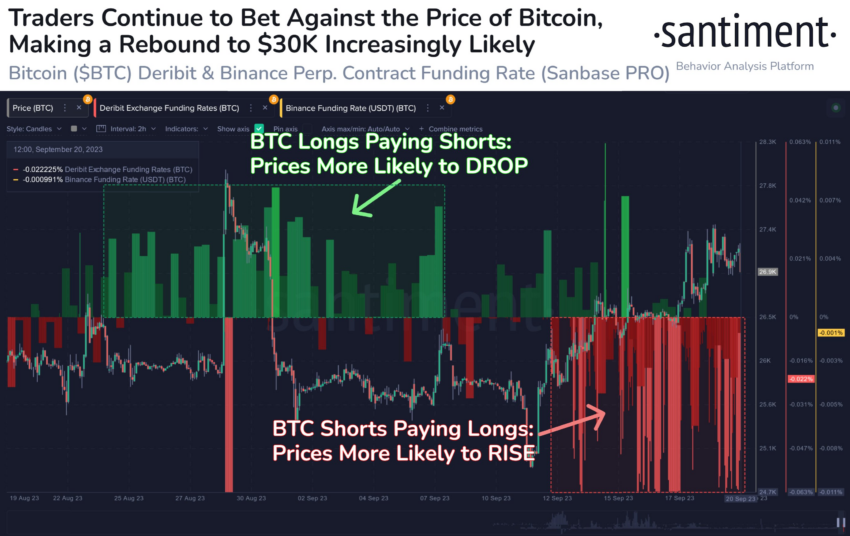

Bitcoin maintained a range-bound trajectory between $26,000 and $27,000 throughout the week, concluding with minimal price change.

Santiment noted the current bearish sentiment surrounding Bitcoin, writing that traders were aggressively shorting it on certain exchanges. However, it added that this action could help push BTC’s price to $30,000.

Meanwhile, Ethereum had a less favorable week as it turned inflationary and experienced a 2.4% decline, slipping below the $1,600 mark. Besides that, network activity has considerably dropped, leading to transaction fees dropping to yearly lows.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link