Uniswap DEX Claims World’s Largest On-Chain Trading Platform

[ad_1]

Decentralized exchange Uniswap has been making headwind and has reached new milestones in terms of the amount of money it has processed.

On June 1, Uniswap Labs made a bold statement that it is the “world’s largest on-chain trading protocol.”

This comes after it revealed that it had processed a cumulative $1.5 trillion in value since inception.

Uniswap DEX Dominance

Uniswap v1 launched in 2018, allowing anyone to swap ERC-20 tokens against Ethereum. In May 2020, v2 was released, introducing direct ERC-20 pools, flash swaps, and an improved price oracle. Version 3 arrived in May 2021, introducing concentrated liquidity and allowing liquidity providers to specify price ranges for their funds.

According to CoinGecko, Uniswap remains market dominant, with its v3 iteration on Ethereum commanding a 31.8% DEX market share. It has processed $607 million in volume over the past 24 hours.

Additionally, Uniswap’s layer-2 v3 on Arbitrum has a 10% market share in terms of volume, with $192 million over the past day. Combined with Uniswap v2 and v3 on Polygon and Optimism, the platform commands almost 50% of the DEX volume market.

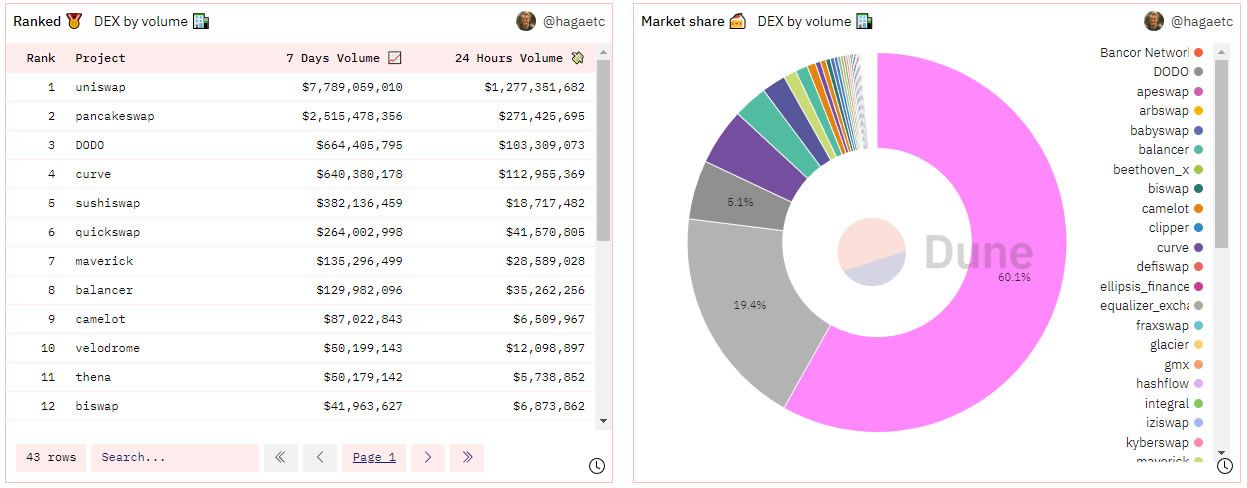

Dune Analytics confirms the data reporting that Uniswap has a 60% share of the 7-day trading volume. According to Dune, it has processed $7.8 billion over the past week.

Following a downtrend in the second half of 2022, DEX weekly volumes have ticked up in 2023. From around $7 billion per week at the beginning of the year, DEX volumes have more than doubled to current levels, according to Dune, which reported $71.4 billion in volume over the last 30 days.

DefiLlama also confirms Uniswap’s dominance but reported that its cumulative volume is lower at $1.07 trillion. It also reports a total value locked of $3 billion for all versions of Uniswap.

PancakeSwap is the second largest DEX after Uniswap in weekly volumes, according to Dune and DeFiLlama.

Earlier this year, BeInCrypto reported that Uniswap could surpass Coinbase’s trading volume in 2023.

UNI Price Lacks Luster

However, the outlook is not so good for the platform’s governance token. UNI prices are down 3% on the day, falling below the $5 level again.

UNI, which is heavily VC controlled, has had a rough bear market, trending down for the past two years. Since its all-time high of $44.92 in May 2021, UNI has tanked 89% to current levels despite its DEX market dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link