Memecoin Madness Slows as Bitcoin Fees Return to Normality

[ad_1]

Memecoin fever appears to be waning as prices of the popular ones such as PEPE are in retreat. This is good news for Bitcoin users but may not be for investors as crypto markets continue to correct.

The memecoin minting frenzy that clogged up the Bitcoin network last week appears to have abated. Furthermore, the frog-themed PEPE memecoin that was the center of attention has lost 60% since its peak earlier this month.

PEPE surged from obscurity to an all-time high of $0.00000431 on May 5. However, it has since dumped more than 60% in a fall to current prices at $0.00000172.

The memecoin is down 4.5% on the day, while markets have gained 1.7%. This suggests that memecoin fever is over for the time being.

The coin’s market value peaked at $1.6 billion before retreating to current levels of around $720 million.

Memecoin Speculation Fading

Speculators often sell some of their BTC and ETH holdings for high-risk memecoins. This appears to be what has happened recently as the top two fall back following several months of gains, reported Bloomberg.

Commenting on PEPE, a trader at digital-asset manager Arca, Kyle Doane, said, “At the end of the day, it’s a lottery ticket,” before adding, “That type of trading is basically a centralized casino.”

The memecoin craze could likely signal a local market top, which is often followed by multi-month drawdowns for Bitcoin and its brethren. A similar scenario played out in May 2021 when Dogecoin (DOGE) led the memecoin boom.

Joe Rotunda, director of the Texas State Securities Board enforcement division, said,

“When the buzz disappears and the hype dissipates, the value tends to plummet and investors can suffer significant losses.”

Cashing out of memecoins can also be problematic due to liquidity issues. However, PEPE still has around $360 million in daily trading volume.

Bitcoin Fees Fall Back

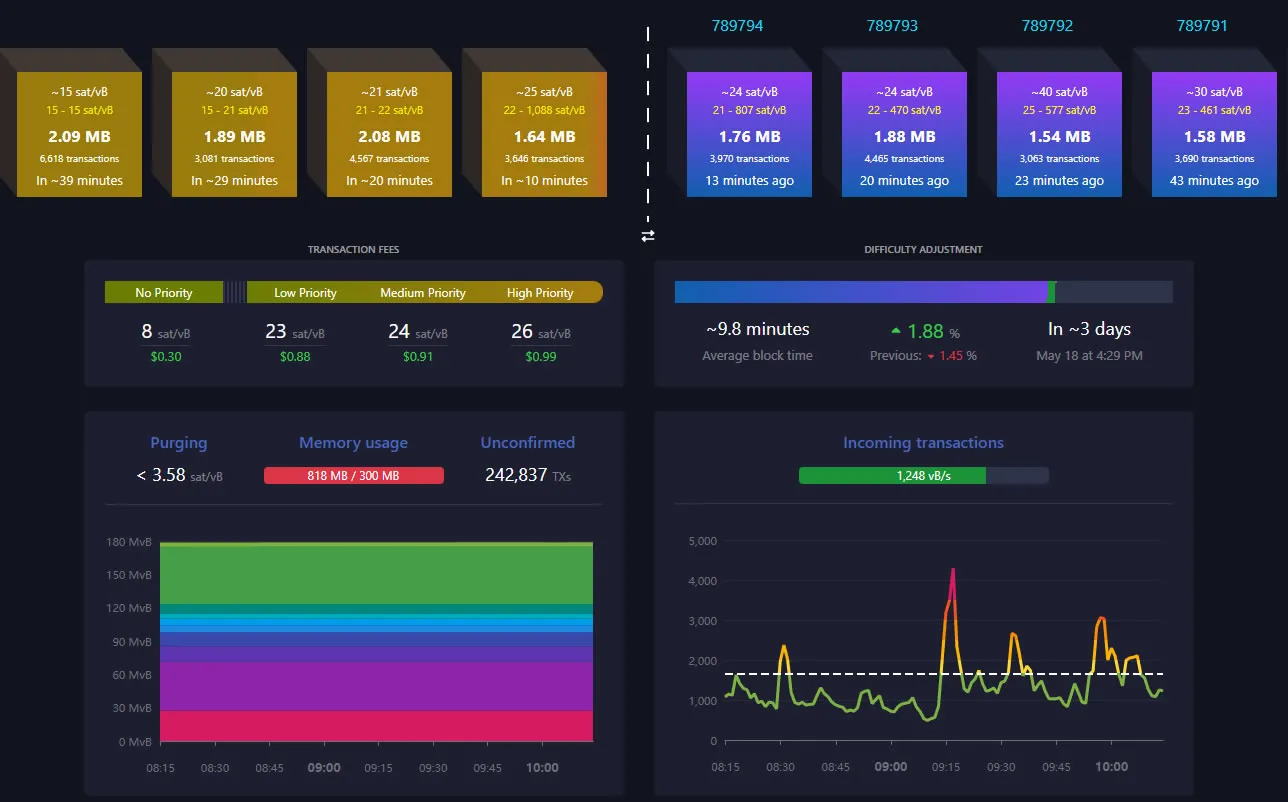

The Bitcoin network has taken a breather now that the meme coin-minting madness is waning. The number of pending unconfirmed transactions in the mempool has fallen to 242,837 as transaction fees stabilize.

Daily transactions still remain high, above 600,000, according to BitInfoCharts data. Fortunately, average transaction fees have fallen back down to around $3.76.

On May 8, fees spiked to over $30 as demand for block space skyrocketed during the height of the BRC-20 and Ordinal inscription craze.

BTC prices were trading up 1.4% on the day at $27,191 during the Monday morning Asian trading session.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link