Justin Sun Mints a Whopping $865M TUSD

[ad_1]

Justin Sun, the founder of TRON, is making headlines for minting $815 million worth of TrueUSD (TUSD), despite the stablecoin experiencing limited adoption in the crypto industry.

On-chain data shows that the Sun minted the TUSD in 10 transactions using different addresses on September 15.

Justin Sun’s On-Chain Activity Raises Eyebrows

The newly created stablecoins were initially transferred to an HTX (formerly known as Huobi) hot wallet address. Subsequently, Sun withdrew $865 million worth of TUSD from HTX and deposited it into a stUSDT mint contract, resulting in the tokens being burned.

In return, Sun generated $865 million worth of stUSDT tokens, which were sent to his own wallet.

Justin Sun has now placed the $865 million in stUSDT tokens into the TRON-based DeFi platform, JustLend. Notable, Sun has deep-rooted connections with all of the protocols and exchanges involved in these transactions.

The recent on-chain activity has sparked concerns within the crypto market. Some worry there might be something brewing behind the scenes that could impact the industry as a whole. Specifically, the nearly $1 billion TUSD mint has prompted inquiries into the full collateralization of the stablecoins.

Dylan LeClair, a contributor to Bitcoin Magazine, directly questioned Sun about these transactions. “What and where are TUSD reserves, where does stUSDT ‘yield’ come from,” LeClair asked.

Sun replied, indicating that treasury bills are the underlying assets providing collateral. In his words: “Answer to all: t-bills.” Still, he did not provide further details regarding the specific types of treasury bills in which the projects have invested.

Data Reveals Little to No TUSD Adoption

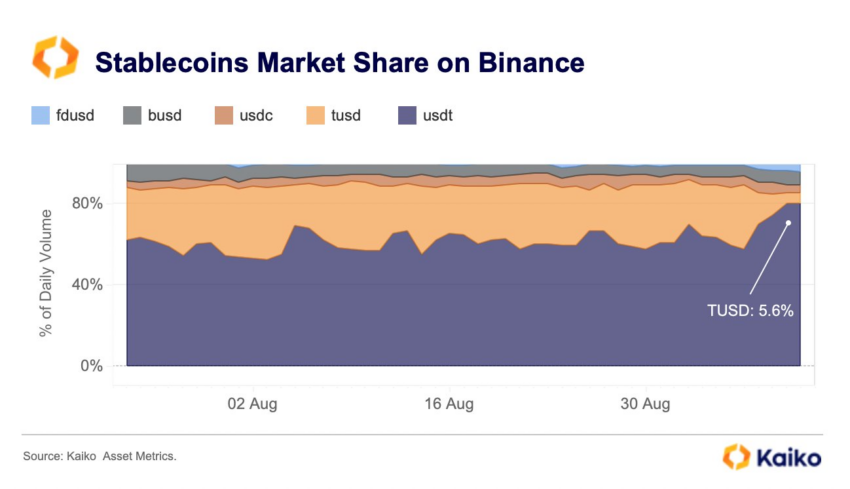

TUSD has recently seen its adoption and usage slow down after Binance re-introduced taker fees for its BTC/TUSD pair. Research analytics firm Kaiko noted that TUSD’s market share on Binance fell to 5.6% from over 30% recorded earlier in the year.

Meanwhile, market observers have raised concerns about several Sun’s projects, citing the possibility of a financial contagion should any of these ventures encounter difficulties. Furthermore, the rapid expansion of certain projects, notably stUSDT, has triggered alarm bells.

Although the stUSDT platform claims to derive its yields from real-world assets through investments in short-term government bonds, it has not presented concrete proof of such investments. Many stUSDT holdings can be traced back to Sun’s personal wallet.

It is worth noting that Justin Sun faces civil charges related to fraud and securities law violations in the United States. However, the crypto entrepreneur has vehemently refuted these allegations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link