Crypto Losses In Q3 2023 Were Because of Two Crypto Projects

[ad_1]

Web3 bug bounty platform Immunefi has revealed that two specific projects were responsible for the majority of the $662,850,580 in losses from crypto exploits in the third quarter of 2023.

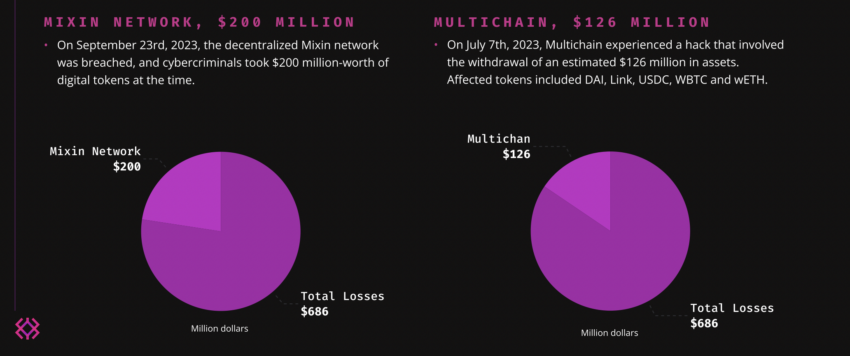

“Most of that sum was lost to two specific projects: Mixin Network, a transactional network for digital assets, and Multichain, a cross-chain router protocol,” the report stated.

Q3 2023 Crypto Losses Surpass Q3 2022 Significantly

The report published by Immunefi highlights 49 reported crypto hacks during the third quarter of 2023. This signified a significant upswing in comparison to the corresponding quarter in 2022.

“These numbers represent a 66% increase compared to Q3 2022, when losses caused by hacks totaled $398,912,483.”

In Q3 2023, the majority of the reported $662,850,580 in losses stemmed from two projects. Mixin Network incurred $200,000 in losses, while Multichain accounted for $126,000 of the total sum.

On September 26, a breach in Mixin Network resulted in the theft of $200 million in digital tokens. Similarly, on July 7, Multichain fell victim to a hack that saw $126 million in assets compromised.

DeFi Saw A Higher Incidence Of Crypto Losses Compared To CeFi

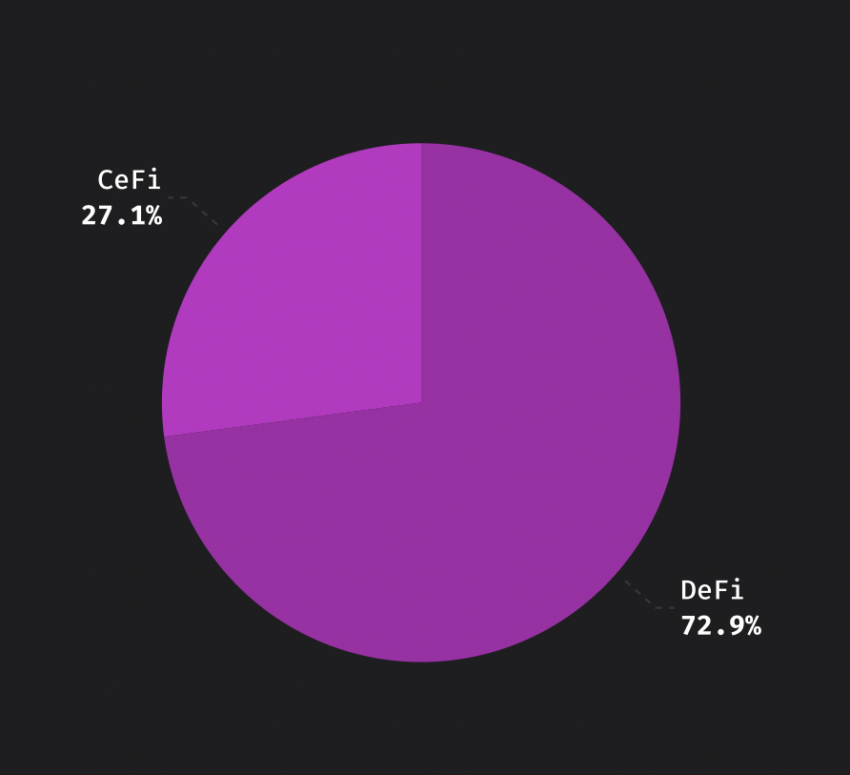

Exploits continue to primarily target Decentralized Finance (DeFi) rather than Centralized Finance (CeFi).

“In Q3 2023, DeFi continues to be the main target for exploits, compared to CeFi. DeFi represents 72.9% of the total losses, while CeFi represents 27.1% of the total losses.”

DeFi has suffered $499,810,444 in total losses in Q3 2023 across 71 incidents. This is an 18.5% increase compared to Q3 2022, when DeFi losses amounted to 423,423,783.

Meanwhile, CeFi suffered $185,700,000 in total losses in Q3 2023. However, at a much lower incident rate of 5. This represents a staggering 3,409.14% surge compared to Q3 2022 when CeFi losses amounted to $5,294,300.

In a recent interview with BeInCrypto, Amer Vohora, CEO of SwissFortress attributes the rise in crypto exploits to outdated infrastructure. He points out that the majority of transactions are still using the same receiving address as outlined in the 2008 Satoshi Whitepaper, which may not be the most optimal choice given the widespread adoption of crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link