Crypto Executive Explains Its Impact

[ad_1]

The founder of two crypto companies highlights how Ripple’s token, XRP, presents a significant threat to prominent banks worldwide.

“Ripple was the first company after 4 decades to threaten the system in such a big depth. They found a powerful weapon and decided to leverage it to democratize the financial system,” Panos Mekras declares.

XRP Could Break Banks Control in Finance

In a recent series of posts on X (formerly Twitter), Panos Mekras, the founder of Digital Generation Financial Services and Anodos, outlines how XRP could potentially shake up the financial industry.

While acknowledging the commonly used argument that the current financial system is “outdated and inefficient,” he points out that the system banks use to send money doesn’t actually involve the movement of funds:

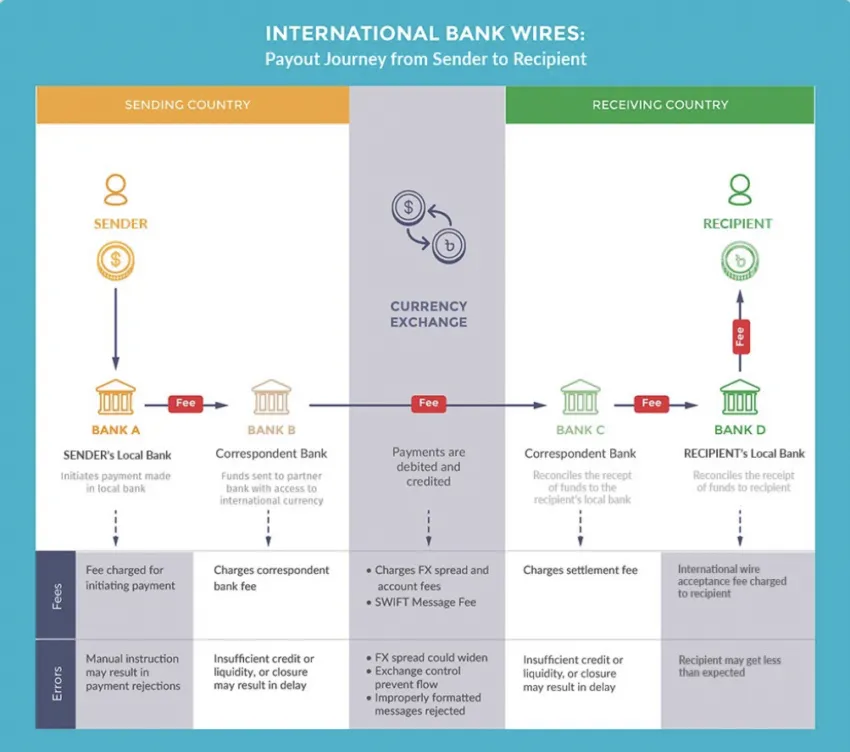

“SWIFT, owned by some of the biggest banks, is the most popular system for sending money around the world with over 10,000 institutions in its network. With this system, no money is ever moved, just account entries in correspondent banks’ ledgers get adjusted (credited/debited).”

He attributes this to small banks facing the challenge in establishing a direct connection and having “pre-funded money” with banks worldwide. As a result, smaller banks depend on larger banks that serve as intermediaries.

He suggests that while other global industries are becoming more interconnected, banks have lagged behind.

“In a time when the global economy is more connected than ever, it’s shocking that there isn’t a complete payments network that allows seamless and efficient transfer of money around the world,” he states. He urges that XRP should be integrated into society worldwide:

“The need for connection, accessibility and interoperability has never been greater.”

However, he explains that Ripple employs a tool that enables XRP to instantly settle funds with “actual transfer of value.” He notes XRP’s ability to present a threat to major banks holding monopoly over the market:

“XRP used as a bridge currency in a cross-border payment can eliminate the need for pre-funded liquidity, as well as the need for the many correspondent and intermediary banks.”

Ongoing Legal Action Against The SEC

Despite Ripple recently achieving a partial victory against the SEC by the court ruling that XRP is not deemed a security when sold to individual investors, the SEC has promptly taken strong measures to appeal the case.

Recently, the SEC was granted approval to file an appeal against the decision.

Ripple and the SEC have both suggested appeal dates for the upcoming hearing, set to occur in Q2 2024.

Ripple states it is available anytime throughout the quarter, while the SEC marked out 19 specific days during the period. However, the exact date is yet to be finalized.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link