Chia Coin Price Prediction 2023 – 2030

[ad_1]

In this guide, we will review past Chia Coin’s market performance and compare it to the present. The goal is to present a four-year prediction of XCH’s value.

Quick Background Of Chia Coin

Before jumping into the Chia Coin price predictions, let’s quickly review Chia Coin’s background and its price history. Chia Coin is the brainchild of Bram Cohen, the programming wizard behind the BitTorrent platform. According to its documentation, Chia officially registered as a business entity in 2017 as Chia Network Inc. The company develops smart transaction platforms to provide utility for its decentralized cryptocurrency, $XCH.

The Chia network uses the proof of space and time (POST) consensus algorithm concept. It works by validating that data held on a certain part of a storage device exists and can be recalled when it’s needed. Upon completing a storage and recall cycle, the owner of the storage device is rewarded with a token.

Chia is praised as the first blockchain-based cryptocurrency to use the “proof of space and time” concept instead of the “proof of work” (POW) used by Nakamoto.

Chia Coin Quick Facts

Chia Coin Price ($XCH): $37.5 (varies)

Total Supply 25,473,665 ($XCH)

Traded Volume/day. $4 to $8 million (varies)

Market Cap $190+ million (Varies)

Peak Price $1934

Dip Price $26.10

Founder Bram Cohen

Launch date August, 2017

Parent Company: Chia Network

Even though Bitcoin keeps asserting itself as the king of cryptocurrency, several other coins are also making headway in the crypto space. Ethereum, for example, grew from a lower market position to become the second most valuable coin in the industry. Solana, Dogecoin, Litecoin, and Bitcoin Cash are some of the other coins that also rose to prominence.

One breakout coin that took the industry by surprise is Chia Coin, which went from zero to more than $1900 in less than 3 years. However, despite its meteoric rise, the Chia Coin also turned out to be one of the few coins that’s witnessed a tremendous impact of price action over its lifetime. It’s gone from its all-time high of $1900+ to an all-time low of $26.

Would the coming years see Chia Coin investors smiling to the bank, or would it send Chia Coin prices spiraling into the abyss?

Welcome to the definitive Chia Coin price prediction. In this guide, we will review past Chia Coin market performances and compare them to the present. The goal is to present a four-year prediction of XCH’s value. At the end of this guide, we’ll present some viable alternatives to Chia Coin. We’ve researched each of the comparative coins and found that they have the potential to yield significant profit in the coming years.

Chia Network Growth Journey

Since its inception in 2017, the Chia network has grown to comprise over 100,000 nodes in over 20 countries around the world. This number makes it the largest PST network in the world.

According to Dealsroom, Chia raised a series of unverified seed funds from angel investors before approaching venture capital funds. The first round of VC funding came from Greylock Partners, Andreessen Horowitz, and Naval Ravikant, totaling $3.4 million. Subsequent rounds of funding came from Slow Ventures, totaling $5 million.

In 2021, Chia Network raised a Series D from Andreessen Horowitz, True Ventures, Slow Ventures, Naval Ravikant, DHVC (Danhua Capital), Richmond Global Ventures, Breyer Capital, and Cygni Capital, totaling $61 million. The funding round brought the valuation of Chia Networks Inc. to a whopping $500 million.

Chia Coin Price History

Chia Coin’s price has witnessed a wild fluctuation over the years. The price kicked off slightly below the $20 mark and climbed linearly until news of its IPO started making the rounds. Within a few months, the price spiked to an all-time high of $1900 (3rd of May, 2021).

The crypto shock of 2021–2022 saw the price plummet to $561 in the same period. On the 15th of May of the same year, we saw another spike in price take place that moved the price to a new high of $1600+. Unfortunately, Chia Coin closed the year 2021 at a low of $160.16. The downward price movement continued well into 2022, pushing the price further down to $64. By December 2022, the price was down to $50. However, the Chia Coin has been witnessing steady growth in 2023, with its price gaining between 0.3% and 9% monthly.

While some investors blame the volatility on the potential of the coin, one can argue that the volatility experienced by Chia Coin is industry-wide and may not entirely describe the coin’s potential.

Chia Coin Price Predictions for 2023

Chia Coin prices in 2023 have been hovering around wide ranges of highs and lows. It opened the year in January with a net low of $28 and reached a maximum price of $47. The price moved to the highest we’ve seen this year in February, reaching the $88 mark. As of the time of this writing, one Chia Coin is valued at $37.97.

Comparing Chia Coin’s performance to the overall performance across the cryptocurrency industry, one would realize that its low performance is not unique. Major cryptocurrencies like Bitcoin, Ether, and other altcoins have witnessed a price shave of not less than 40%–55% within the same period. However, recent trends in the crypto market are tilting towards a bullish run as a result of the sudden crises bedeviling the banking sector. Bitcoin has risen from a low of $16,000+ to $36,000+ in four months, which is about a 45% leap in price. Other altcoins have also witnessed a price shift in the range of 30% to 56%. Chia Coin is also increasing in value along with industry-wide positive performance.

Chia Coin price chart

Currently, Chia Network is initiating sector-wide utilities. Part of the initiative includes the DeFi implementation, NFT natives, and other projects that leverage the native smart contract of the Chia network, Chialisp. The growing usage gives XCH new potential. Chia Coin has begun to record gradual growth over the past few months. It has recently recorded as much as a 9% increase on its January price, which brought it to $37+ in April.

Statistics show that the current growth rate may see the coin reach the $41 mark in the coming months. With the current trends across the cryptocurrency sector and the increasing utility of Chia in NFT and DeFi, there is a likelihood that the coin may close the year 2023 in the range of $70+ to $100. Also looking at the Greed Index of Low Chia Coins, which is in the range of 60 to 70%, one would see that there’s a prospect of a positive increase for the coin.

The coming IPO could also contribute to the climb in Chia Coin prices. Speculation has it that the coin may go public in 2023 or 2024. If the IPO occurs, it could raise massive public confidence and interest in the coin, which would push the price to new highs. Chia Network, Inc. attempted its IPO after the Series D funding round.

However, certain factors prevented the company from going forward with the plan. The company changed its leadership in January of 2023, which saw Gene Hoffman taking over as the CEO of the company. The move is to position the organization for the IPO move. If the IPO goes through, the rise of the Chia coin price is inevitable.

Chia Coin Price Predictions Beyond 2023: 2024–2025

Despite the fact that the world economy and financial infrastructure are going through the toughest time, there’s a record high level of optimism for the crypto industry. Trends like Web 3.0 and the rise of NFTs have created a massive demand for cryptocurrencies. The behavior of Chia Coin in the coming years depends on its growing utility and infrastructure.

Also, there are funding opportunities available for Chai Coin, which could also influence the ability of the company to scale its operation. So far, Chia Network has raised a total of $65 million, according to Crunchbase. The company’s chief executive, Gene Hoffman, also informed Bloomberg that there are plans to raise more capital, which include taking the company public. Moves like this only strengthen the performance of an asset in the market.

When it comes to utility, the coin is currently making moves that would create more demand for XCH. One of the factors that contributed to the growth of Ethereum is the integrated smart contract that opened the way for extensive utility in various secured transactions and economic activities.

Chia Network has also crafted its own in-built smart contract, Chialisp. With growing adoption and deployment of the Chialisp smart contract, the potential of Chia Coin would be unlocked.

Platforms like NFTs would benefit from the adoption of Chialisp. Market trends in derivatives and NFT show that there’s a huge opportunity for any network that offers stability and a lower gas price. ChiaLisp may move in to capitalize on these opportunities.

Looking at the price history of Chia coins, it reached an all-time high of $1600+ without showing significant promise of utility. One can easily predict that Chia would have a higher bullish run in the coming years if it brings its ChiaLisp to full use.

Before one can successfully predict the future price of XCH, it’s best to also look at negative factors that may contribute to downward price movement.

Chia Coin Price: Red Flags

First, Chia Coin is not built on scaleable infrastructure. Therefore, the future prices may not match the likes of Ethereum, Bitcoin, or other major cryptocurrencies. Competition from established competing cryptocurrencies may put downward pressure on the performance of Chia Coin in the market, which may also reduce the performance of the coin in the market. Government policies and data control could also prevent the execution of “Proof of Space and Time” in the future. Such policies spell an immense threat to the fundamentals of Chia Coin’s workings.

Therefore, it’s only logical to place the potential rise of the Chia coin at an average of $700+. The price could exceed that amount or fall below the mark. However, it’s unlikely that investors will record thousands of dollars in returns per unit of XCH.

Chia Coin Utility

How Chia Coin is deployed in everyday life may also contribute to its future price. Below is a quick highlight of the various ways the Chia Coin, Chia Network, and Chialisp are being used worldwide.

Chia Farmers Rewards

Chia Coin uses a unique mining process. Major crypto currencies use hash methods to generate proof of work that results in the mining of cryptocurrencies. Chia coins, on the other hand, use the Proof of Space and Time method. The mining process is referred to as “farming,” and each farmer gets XCH for participating in the network. The bigger the network, the more utility there is for Chia Coins.

DeFi

Due to its inbuilt smart contract, Chialisp developers are executing DeFi projects on the Chia blockchain, which happens to have a cheaper GAS fee and require fewer infrastructure investments. Also, it is more stable than the available alternatives.

Digital Transactions

Chia Coin is gaining traction in the decentralized economies. With presence in over 20 countries, certain transitions are now happening in XCH, especially across the network. The coin may enter mainstream transactions as the network expands its operations. The success of the IPO would also open new markets and expand its adoption.

dApp Development

Just like its use in DeFi, Chia blockchain and Chailisp are being extensively deployed in decentralized applications. The Chia Network dApp programming platform is still in the development phase and will soon start seeing deployment across Web 3.0.

Asset Tokenisation

The use of smart contracts in non-fungible tokens (NFTs) would pave the way for Chia coins in the future. Analysts believe that the lapses of established NFT platforms like Ethereum and Solana may pave the way for newer-generation smart contract platforms like Chialisp. But nothing much is happening in that space yet. The coming years may be very different ones.

Other Factors That May Contribute to the Growth of the Chia Coin

Besides utility, the following strengths can also work in favor of the chia coin, pushing its value beyond the $500 mark or even cracking a new all-time high.

Great Founder

Bram Cohen is considered one of the best protocol developers of our time, if not the best. With his track record in the industry, it’s easier for investors to trust his ability to develop a world-class project that would stand the test of time. He has pledged to commit another 10 years of his career to working at Chia Network, contributing his skills, experience, and expertise to the development of the project.

Great Leader

Earlier this year, Chia Network brought in a new crop of experts who have done so well in tech and finance. The new CEO, Gene Hoffman, has successfully raised over $155 million in his career as a business leader. His expertise also holds a promising future for Chia Network.

Great Team

Besides the CEO, other hands came onboard as the leaders of the company. Each person on the leadership team has world-class skills at what they do. Looking at their track records and contributions to their industries, one can only conclude they’ll take the company to its peak.

First-mover Advantage

Being the first proof-of-space-and-time platform to hit the internet is another area that gives the Chia network immense strength over other competing platforms. It has gained the name and secured the brand as the initiator of the new trend.

Patents and Proprietary Technology

Chia holds three patents in the blockchain sector, and it has two others in progress. With these patents under its belt, it would prevent other movers from gaining speed to catch up and neutralize its growth.

Will Chia Coin Disappear Soon?

In 2022, analysts predicted that the Chia Coin would lose all its value and vanish from the market forever. Contrary to their prediction, the coin survived the worst downturn ever witnessed in the cryptocurrency sector. Prior to this, it had survived a major crash that wiped out up to 98% of its value. Even after all the turbulent years, the coin is still around.

As a matter of fact, it has begun to gain value against all negative predictions. The seeming resilience of the coin shows that there’s a brighter future ahead of it. Due to obvious evidence and market trends, the coin is showing no signs of evaporation, and the company is working hard to unlock more of its values. Looking at all the utility that’s being added to the platform and the prospect of an IPO, there’s a high chance we might be seeing Chia Coin around for the next 10 to 20 years.

Should You Invest in Chia Coin in 2023?

The best time to purchase any coin is when it’s relatively new and has not yet experienced major volatility. Chia Coin has gone through two major periods of volatility and has endured over six months of downward price movement. While the coin may hold huge potential and opportunity in the future, it may not be an ideal short-term investment in 2023’s volatile economy. Below are some recommended coins that are showing immense growth potential. However, we’re not disputing the potential of Chia Coin. Purchasing one or all of the coins below could bring sizeable returns in the short run.

Alternatives to Chia Coin

Alongside our Chia Coin price prediction, we’ve also picked out some alternative investments:

Love Hate Inu $LHINU

Love Hate Inu (LHINU) is a memecoin that’s developed around the concept of social utility, similar to Shiba Inu. The coin is a blockchain-based project that gives token holders the power to vote on topics of interest and rewards holders for participating in polls. What gives Love Hate Inu an edge over conventional voting platforms is the immutable blockchain technology that forms the underlying infrastructure. Currently, 1 LHINU is worth 0.000105 USDT ($0.00011).

Being the first in the market, the coin is tapping into a multi-billion dollar online survey and voting market. The need for a dependable voting platform would push the demand for the platform to a new high. As the platform gains more popularity, the value of the token will also increase. Right now, Love Hate Inu rewards users based on voting and engagement.

The voting is done via polls, and participants must hold LHINU to vote. Upon staking and voting, users earn more tokens as a reward. The more staking and voting users engage in, the more rewards they earn from the platform. Unlinked from most memecoins without real utility, $LHINU presents utility that would be relevant for years to come. Now may be the best time for investors to seize the opportunity to earn sizeable returns when it finally picks up.

$LHINU Tokenomics

The Love Hate Inu coin is denoted by the $LHINU, which is also the native token of the coin. The coin distribution follows a simple model. It has a total of 100 billion coins in its system. It is raising most of its capital through a presale offer, which gives it the chance to give away 90% of the coin to the community. Since there’s no venture capitalist or corporate investor to take a chunk of the funds, the remaining 10% is held in reserve for price regulation and rewards.

Love Hate Inu – Newest Meme Coin

Decentralized Polling – Vote to Earn

Early Access Presale Live Now

Ethereum Chain

Featured in Yahoo Finance

Mint Memes of Survey Results as NFTs

Staking Rewards

Viral Potential, Growing Community

Deelance

Deelance has launched a project targeting its solutions at the undeserved freelance sector. The platform is built on blockchain technology, creating a decentralized outlet where freelancers and employers can interact and transact freely. Users are rewarded with the native token of the platform, $DLANCE, which also serves as the currency and governing token. The coin holds a promising feature in that it has found a way to include a combination of platform and complementing utility in its backend. The platform is built with a focus on Web 3.0 utility. Moves like this indicate a potential for future growth. As of the time of this writing, the presale price of the Deelance is 1 $DLANCE = $0.025 USDT ($0.025). Deelance utility targets the freelance market market that’s $12 billion dollars.

Being the first decentralized freelancing platform in the world presents huge potential in terms of demand and utility. The coming months and years may see the price of cryptocurrency fly up by over 100%. With the launch price set at $0.037, buying Dance now still puts a margin of $0.010 or more in an investor’s pocket. Ultimately, the price could go up to hundreds of dollars when it finally takes off. It’s critical to mention that pre-sale prices go up frequently. Therefore, the price listed here may change in the coming days.

$DLANCE Tokenomics

$DLANCE has a total supply volume of 1 000 000 000 units. Below is a quick highlight of how the supply is allocated.

10% of that unit is reserved for the team.

30% of the units are offered to the public in presale.

The presale would happen in 7 rounds, starting with 24 000 000 units in the first round and going up to 115, 208, and 333 units in the final round.

2% is reserved for airdrops.

14% is reserved for advisers and partners.

10% is reserved for liquidity.

12% is kept for the ecosystem.

16% is reserved for CEX listing.

The platform has not raised funding from venture capital institutions, which means it would not reserve any of its units for corporate investors.

DeeLance – New Web3 Coin Presale

First Decentralized Freelancing Network

Find Employers in the Metaverse

NFT Marketplace, $100k Giveaway

Presale Stage One Live Now

SolidProof & Coinsult Audited

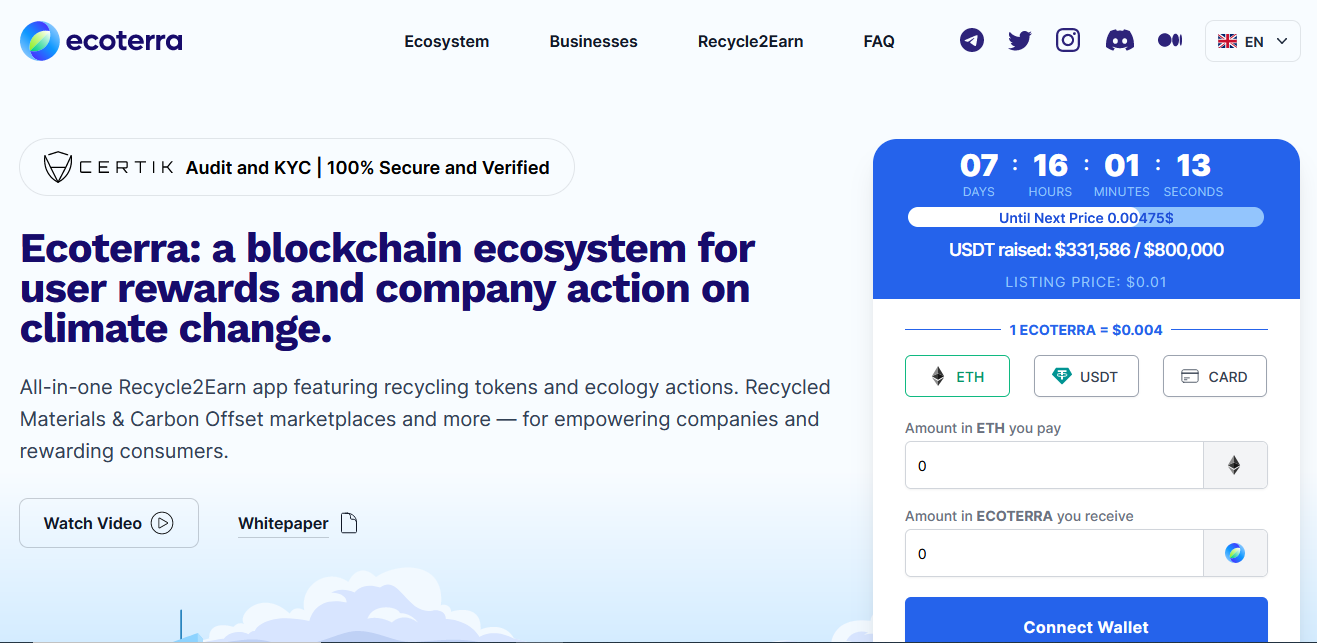

Ecoterra

Ecoterra is a climate-focused project that encourages the public to take positive environmental actions. The project features innovative solutions built on blockchain technology. Its reward system features a native token, $ECOTERRA, which users receive from participating on the platform. It’s also used for platform-wide governance. To earn a token on Ecoterra, users are required to deposit recyclable items at registered locations and provide proof of action via photos or scanned barcodes. Ecoterra has positioned itself as the first recycling solution built on blockchain technology. With worldwide adoption, the platform may be leading a revolution in a multi-million dollar sector. Currently, the presale of Ecoterra is offered at 1 $ECOTERRA = $0.004.

$ECOTERRA Tokenomics

$ECOTERRA is set to launch with 1.1 billion units of its token, and 1 billion units of that supply (90.9%) would be released to the public in the presale. The presale is divided into 9 stages, and stage one is currently ongoing at $0.004 per EXOTERRA. A total of 200 million units are up for sale at this stage. Subsequently, they would come in at a higher margin, leading to more supply of the token.

Ecoterra – New Eco Friendly Crypto

CertiK Audited

Doxxed Professional Team

Earn Free Crypto for Recycling

Gamified Environmental Action

Presale Live Now – $1.5M+ Raised

Yahoo Finance, Cointelegraph Featured Project

Conclusion

We speculated on a potential Chia Coin price prediction in this guide. Having gone through the company’s background and its current performance, one would not be wrong to conclude that there’s a bright future ahead of the company. However, new investors can secure their asset portfolio by investing in other upcoming crypto assets like Ecoterra, Deelance, and Love Hate Inu. These assets have positioned themselves to tap into markets that are worth billions of dollars. As blockchain, the metaverse, and Web 3.0 become mainstream, each of these coins will see a tremendous increase in value. Chia coin would also witness a price increase down the line, but it’s best to hold XCH as a long-term investment rather than a short-term investment.

FAQs

Why is the Chia Coin price dropping?

The drop in the price of Chia is not unique to the coin. The entire cryptocurrency sector experienced an industry-wide price crisis between 2021 and 2022. The crisis is also reflected in the price of Chia seeds. However, Chia Coin has seen a significant price gain in 2023. And analysis shows that the price is likely to go up in the coming months and years.

How old is Chia Coin?

Chia Coin was launched between March and August 2017. As of the time of this writing, Chia Coin has been around for 6 years. much newer than most cryptocurrencies but showing so much resilience.

How can I buy Chia coins?

hia Network uses a peer-to-peer transaction system backed by stablecoin. Users need a stable Prime account to successfully fund the XCH wallet. Therefore, the first step is to set up stable prime access. Once the account is ready, you can then download the Chia wallet from the website and fund the wallet through your stable Prime account.

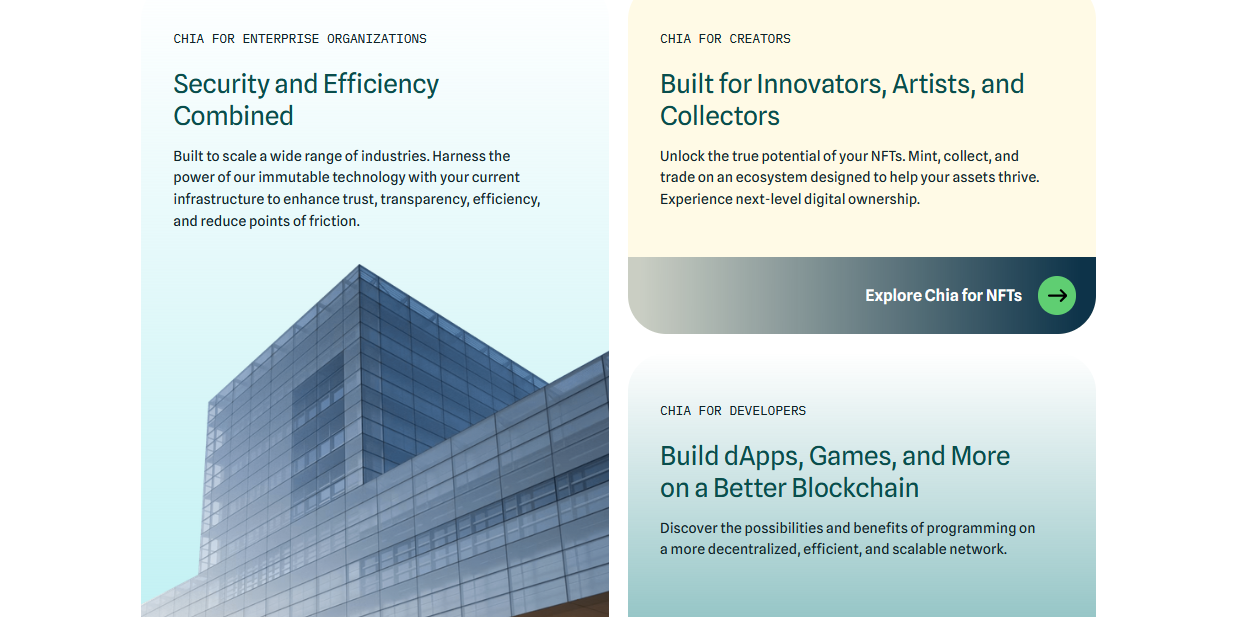

How are new Chia Coins (XCH) created?

Chia Network uses the term ‘farming’ to denote the coin mining process. In simple terms, the process involves storing and securing Chia blockchain data in unused spaces of storage and making it available on demand. Users who engage in this process are referred to as ‘XCH farmers.’ Every 10 minutes, the system issues 64 XCH to 32 farmers in return for participating in the network. The tokens go through a periodic halving every three years.

Proof of Space and Time is a much newer consensus algorithm that requires a prover to send data that shows that certain amounts of disc space have been reserved over time. Once the verification goes through, the system rewards participants with digital tokens. It depends heavily on the efficient use of storage spaces. However, the algorithm has received backlash for reducing the life span of storage devices.

[ad_2]

Source link