Can “Smart Financial Contracts” Stop the Next Financial Crisis?

[ad_1]

The financial system is in dire need of transparency, and blockchain, believes Ralph Kubli, a board member of the Switzerland-based Casper Association. Luckily, the industry is waking up to blockchain’s benefits. BeInCrypto spoke with Kubli about how openness, standardization, and “smart financial contracts” can make all the difference.

The global financial crisis of 2007-9 was an epochal moment for both finance and technology. The monumental levels of negligence, and the resulting economic fallout, turned an entire generation against the excesses of Wall Street. The event even spurred the creation of Bitcoin, the world’s first cryptocurrency and the first successful implementation of blockchain.

A Lack of Transparency Caused the Financial Crisis

Of course, one of Bitcoin’s pluses is its transparency. It exists on a distributed public ledger, or blockchain, which is visible to anyone who wants to look. A level of transparency that the pre-2008 financial system badly needed, according to Kubli.

“The problem leading to the 2008 crash was opaqueness in financial products surrounding cash flows,” he told BeInCrypto.

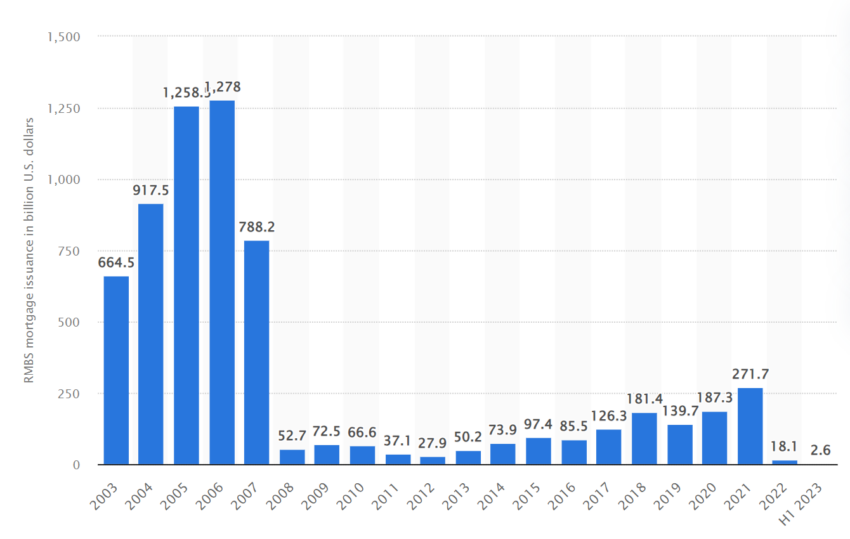

In particular, the lack of transparency in mortgage-backed securities before the financial crisis was a ticking time bomb. Investors and regulators had difficulty assessing the quality and risks associated with these complex financial products, leading to a loss of confidence in the market.

Banks sold high-risk products as safe. “But they had low-quality products bundled in as well,” observed Kubli. “Investors were not necessarily educated on the risk they were taking, and once things began to default, it caused a massive ripple effect through the entire economy.”

Smart Financial Contracts: One Step Further Than Transparency

But what if transparency isn’t enough? During the 2008 financial crisis, many signs of the impending doom were visible for those who cared to look.

Granted, the rating agencies assigned inflated ratings to risky financial products, breaking the market. However, as fans of The Big Short (book or film) will know, the actual bad mortgages bundled into the products were available to see. After all, transparency without scrutiny is like an unread open book.

Therein lies the impetus for the financial industry—and blockchain in particular—to go further than simple transparency.

“What we actually need are smart financial contracts,” said Kubli. “If built properly, smart financial contracts encode not only the information about the tokenized financial asset, but also clearly define all payment obligations of the parties to the financial contract, i.e., cash flows.”

Normal smart contracts act something like a vending machine. Just as when you press the right sequence of numbers and pay the requisite funds, an item of food will fall off its shelf. Their use in decentralized finance (DeFi) has enabled the creation of an entire trustless financial system. However, we must use the term carefully.

“The term smart contract as used currently is a misnomer. Smart contracts are not necessarily smart, nor are these contracts,” said Kubli.

In simple terms, a smart financial contract would curb risk by including all potential downsides of a trade. Innovation in trading and securitization will flow from higher quality of information and efficiency in price discovery, making use of term sheets that machines can read and execute, Kubli argued.

He went on:

“Firm-wide risk management becomes easier, and systemic risk management is again possible. The entire system would be transparent and machine-auditable, and could easily be stress tested for various market conditions. There would be no room for “surprises” or fraud to perpetuate.”

Progress and Institutional Adoption Are Coming

Considering the compelling advantages of blockchain and smart contracts in finance, why aren’t large institutions and banks utilizing this technology to a greater extent? Kubli believes it’s on the way.

“I would submit that the wheels are already in motion,” he said. ”We’ve seen Siemens unveiling its first digital bond, HSBC bolstering its ranks in preparation for greater interest in tokenization, and CitiGroup predicting the market for tokenization of real-world assets to reach between $4 trillion to $5 trillion by 2030.”

A shift is obviously taking place, Kubli said.

“Add to that, BlackRock applying for a spot bitcoin exchange-traded fund (ETF), Invesco reapplying for approval to offer a spot bitcoin ETF, and Deutsche Bank applying for a digital asset license in Germany. Tokenized applications for repo contracts are running for customers of JPMorgan Chase and UBS.”

In Kubli’s view, the other front line in the battle for a better financial system is standardization. So that when looking under the bonnet of a financial product—whether we do it, or a computer—it is easier to understand and assess risks.

One organization with this goal, and the “best example” in the view of Kubli, is the ACTUS Foundation.

“ACTUS is a US-based non-profit, specifically established in the wake of the 2008 financial crisis to create a standardized algorithmic definition of cash-flow patterns of financial instruments,” said Kubli.

“Their solution was an open-source standard that any business could use. The Casper Association is now working on integrating the ACTUS standard with projects building on The Casper Network blockchain,” he added.

This is the way forward for the financial industry, Kubli argued.

Innovation in Payments Does Not Equal Innovation in Finance

Kubli believes the industry is right to be excited about the blockchain revolution. However, some in crypto and blockchain may have begun celebrating too early. For Kubli and many others, the revolution is unfinished.

“Blockchain is the most important technology in finance since the introduction of computers in banks in the 1960s,” he said.

But all too often, people mistake mere changes in the methods of payment for financial innovation. The latter involve the exchange of cash flows over a given period, Kubli stated.

“Without an open source, standardized and algorithmic definition of the underlying financial instrument, none of these new DLT or blockchain-based rails will be adopted on scale, as the new rails will just add on costs to existing players and not change the value chain,” he added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link