Among Blockchains Supporting NFTs, Here’s Why Ethereum Will Remain On Top

[ad_1]

Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum, a decentralized blockchain with smart contract functionality and the second-seeded digital asset after Bitcoin, continues leading the non-fungible tokens market in terms of trading sale volume. Even though many blockchains have begun to support NFTs, we shall narrow down several reasons suggesting that Ethereum might stay on top than expected.

Top Five Blockchains Supporting NFTs:

1. Solana

Solana is a renowned blockchain platform that uses a proof-of-stake mechanism to provide smart contract functionality. For the longest time, Solana has been one of the strong competitors to both Ethereum and Cardano before losing the non-fungible token market dominance to Bitcoin in the past few weeks.

Since its inception in 2020, Solana has attracted mainstream crypto and NFT investors. Some notable NFT projects hosted on Solana include the Degenerate Ape Academy, Solana Monkey, SolPunks, Frakt, Bold Badgers, and Sollamas.

2. Binance Smart Chain ( BNB)

Binance Smart Chain is another blockchain supporting different non-fungible token projects. Binance Smart Chain runs alongside the BNB Chain, previously Binance Chain. The first chain supports smart contracts, while the second enables high transaction volume with 3 seconds block time. Both blockchains together form Binance Chain “BNB.”

Despite Ethereum’s NFT market dominance, the Binance Smart Chain (BNB) has attracted many users and projects because of its strong performance and affordable costs. The BEP-721 token standard developed by BSC enables the development of NFTs.

3. Polygon

Polygon, an Ethereum scaling protocol, has been imposing strong market pressure on Ethereum and Solana before somewhat fading earlier this year. Polygon is a strong chain and much cheaper in transaction fees when compared to Ethereum.

The Polygon is one of the best options for those tapping into a growing market and looking for low gas fees. However, if you want more liquidity and list your collection alongside blue-chip NFTs, Ethereum automatically becomes a better choice. The average of an NFT on Polygon is less than $10, while on Ethereum, it costs about $345.

4. Bitcoin

Bitcoin was the first blockchain to be launched that functions independently of any central authority. Despite being the flagship chain, Bitcoin has been outpaced by other junior blockchains like Ethereum in various fields, including the NFT market.

Bitcoin officially entered the non-fungible token space earlier this year after Bitcoin developer Casey Rodarmor inscribed NFTs using Satoshi’s ordinal theory. By leveraging this innovation, Ordinals can store the entire data for images or video on-chain. Recently, Bitcoin-based NFTs have gained mainstream adoption, poising new threats to Ethereum NFT market dominance.

5. Ethereum

Ethereum is the second most traded crypto blockchain, right behind Bitcoin. Ethereum was the first chain to support non-fungible tokens and has since remained the most widely used blockchain for NFT initiatives. Ethereum is now at the cutting edge of blockchain technology.

The non-fungible token market leader “Ethereum” features two well-liked native tokens dubbed ERC-721 and ERC-1155, which are used to construct non-fungible tokens and semi-fungible tokens. Despite many market conditions and threats, Ethereum slashes the lion’s share in the NFT market.

Ethereum Might Remain On Top; Here’s Why

It’s worth noting that blockchains manage to build successful non-fungible token markets because of their liquidity capacity and network effects, among other factors. In that case, the more liquidity a blockchain network has, the more it attracts builders or creators.

Bitcoin is the only blockchain that can contend with Ethereum when it comes to liquidity. The flagship crypto has a market capitalization of approximately 2.5 times larger than Ethereum, giving it huge potential to outperform Ethereum. But is the liquidity factor alone enough to give out results? The answer is no.

Solana is a perfect example, showcasing that liquidity is not the determining when it comes to non-fungible token dominance. Despite having a lower market capitalization, Solana has higher liquidity for NFTs than Cardano. Since the liquidity for jpegs on Ethereum is still much higher, it might continue dominating the market longer than expected.

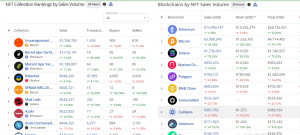

The State Of Blockchains By NFT Sales Volume

Blockchains By NFT Sales: Source: CryptoSlam.io

Ethereum continues dominating the non-fungible token market, attracting a trading sales volume of 13 million in the past 24 hours. During this period, Ethereum has pumped 4% in NFT sales. Bitcoin distantly follows, attracting $3 million in NFT sales. It has increased by 38% in the past 24 hours.

Related NFT News:

Wall Street Memes – Next Big Crypto

Early Access Presale Live Now

Established Community of Stocks & Crypto Traders

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Best Crypto to Buy Now In Meme Coin Sector

Team Behind OpenSea NFT Collection – Wall St Bulls

Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

[ad_2]

Source link