After years of mostly unkind words for the crypto industry, 2023 was the year that U.S. regulators took out the sticks and stones.

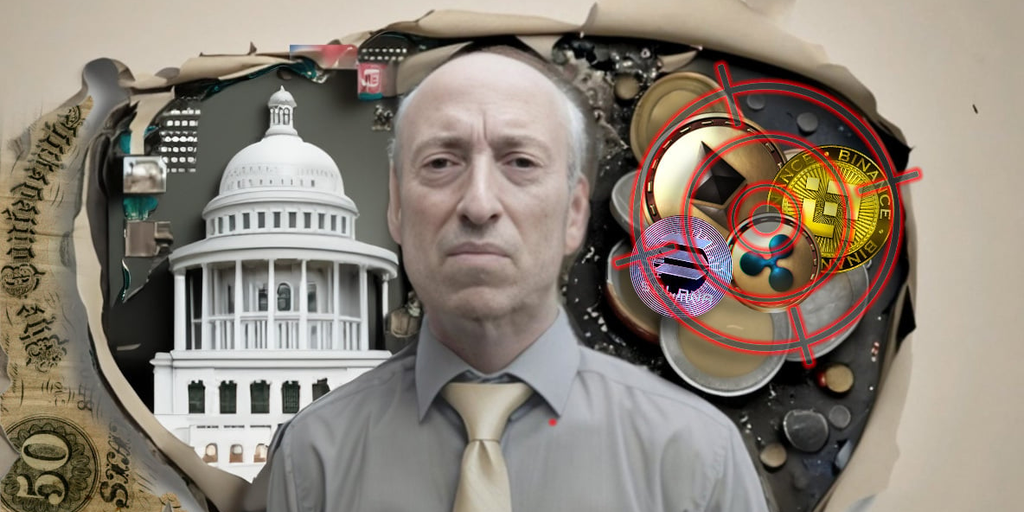

Following the collapse of criminally mismanaged crypto brand FTX in November 2022, Wall Street’s top regulator, the Securities and Exchange Commission, had the perfect reason to crack down on an industry full of “hucksters, fraudsters and scam artists”—to quote SEC chair Gary Gensler.

But has the crackdown gone too far?

Some U.S. lawmakers, including the crypto-friendly Majority Whip Tom Emmer, have criticized the regulator for “stifling innovation” in the world’s biggest economy.

Republican Patrick McHenry (R-NC) accused Gensler of wanting to “choke off” the crypto industry. Even the courts have slammed the SEC over its “arbitrary and capricious” denial of digital asset fund manager Grayscale’s application to turn its crypto fund into an ETF.

“The SEC’s crusade against many crypto exchanges seems like an intentional plan to leverage opacity in the law to advance a political agenda through regulation by enforcement that may not be as aligned with consumers’ interests as the Commission claims,” Anthony Glukhov, associate at Ramo Law PC, told Decrypt.

But it wasn’t just the SEC that went after major crypto brands: The Commodity Futures Trading Commission (CFTC) and the Department of Justice were aggressive in pursuing alleged rulebreakers in the digital asset space.

Gensler had said in 2021 that consumers needed protection in the crypto industry. But when FTX suddenly went bankrupt in November, and its now-convicted criminal boss Sam Bankman-Fried was arrested a month later, regulators quickly upped their game.

The first 2023 enforcement action was filed in January against Genesis and Gemini. By late November, Changpeng Zhao (CZ), founder of the world’s biggest crypto exchange, had stepped down from his post as CEO at Binance and pleaded guilty to money-laundering violations.Here’s how we got there:

January: SEC fires first shots of the year

The SEC moved fast—starting the year by hitting crypto lender Genesis and digital asset exchange Gemini with charges for allegedly raising billions of dollars’ worth of crypto from hundreds of thousands of investors in an unregistered securities offering.

Gemini CEO Tyler Winklevoss responded by calling the SEC’s actions “totally counterproductive.”

Genesis, a subsidiary of Digital Currency Group (DCG), later that month filed for bankruptcy, revealing exposure to collapsed crypto venture fund Three Arrows Capital. The lender had been a provider to Gemini for its Earn program but it froze withdrawals following the collapse of FTX in 2022.

Later that same month, stablecoin giant Circle announced it would ditch its plans to go public via a $9 billion SPAC merger—a sign that the regulatory environment was beginning to worsen for digital asset companies. A Circle spokesperson told Decrypt, however, that the company did not blame the SEC for the deal falling through, insisting that Circle never expected the process to be “quick and easy.”

Closing out the month was crypto lender Nexo—one of the last digital-asset lenders standing after bankruptcies at Celsius and BlockFi. (Disclosure: Nexo is one of 22 investors in Decrypt.) The SEC settled charges against Nexo on January 19, with the crypto lender agreeing to pay a $45 million fine over allegations that its lending product was an unregistered security.

February: Releasing the Kraken

Kraken was next.

On February 9, the SEC alleged that the major American crypto exchange violated securities laws by failing to register the offer and sale of its crypto asset staking-as-a-service program. Kraken paid a $30 million fine, without admitting or denying the allegations in the SEC’s complaint.

In an interview with Decrypt a few months later, the exchange’s chief legal officer Marco Santori said that getting targeted by regulators was expected when working in the digital asset industry. “If the SEC or a federal regulator never gets involved, you might not be trying hard enough,” he said. This wouldn’t be the last time the SEC came knocking on Kraken’s door in 2023.

The same month, the SEC also issued a Wells notice to warn fintech company Paxos that it would pursue legal action against the New York firm for its involvement in minting the Binance USD (BUSD) stablecoin. The Commission alleged that the digital token was a security—something Paxos vehemently denied. It then halted minting the token and said it would stop its relationship with Binance to prepare for the lawsuit.

March: CFTC files first Binance lawsuit

The CFTC was the first U.S. agency to file a lawsuit against Binance, the biggest digital assets exchange. It alleged in a federal court that its boss, Changpeng Zhao, and his company violated trading and derivatives rules by allowing Americans to trade crypto options since at least July 2019. It was the first of many times during the year when Zhao would use his now-famous “4” to dismiss the claims in the lawsuit as FUD. The crypto mogul said that posting the number on Twitter was shorthand for “ignore FUD [fear, uncertainty, doubt].”

He used it frequently throughout the year, including when newspapers like the Wall Street Journal said in March—citing text messages—that the exchange had deliberately dodged U.S. authorities.

The CFTC action marked a pivotal moment in the regulatory crackdown against crypto’s biggest players, as federal criminal charges against Binance and its founder would later follow.

April: Bittrex came next

By April, the SEC hit crypto exchange Bittrex with a lawsuit for allegedly failing to register as a broker-dealer, exchange, and clearing agency—and taking in at least $1.3 billion in illicit revenue between 2017 and 2022.

The action was significant, marking the first time that regulator singled out some familiar names in the crypto space as unregistered securities: OMG Network (OMG), Dash (DASH), Monolith (TKN), Naga (NGC), Real Estate Protocol (IHT), and Algorand (ALGO) were all listed in the complaint.

Bittrex claimed in a statement that it had previously asked the SEC to be clear on what coins and tokens were securities—to no avail. In March, it shuttered its American operations. The exchange would later in August agree to settle but it would be just the beginning of its downfall. By November, the exchange would shut down globally.

June: SEC brings out the big guns

By summer, things really began to heat up. On the heels of CFTC’s lawsuit against Binance in March, the SEC then followed up in June with its own shot at the two biggest brands in crypto: Binance and Coinbase.

Although the facts alleged in each lawsuit were different—notably, the regulator accused Binance of fraud but not Coinbase—it’s likely not a coincidence that they were filed the same week.

Another key difference: CZ was mentioned as the main defendant in the Binance lawsuit; Coinbase CEO Brian Armstrong was mentioned just once in his exchange’s complaint.

In its lawsuit against Coinbase, the SEC alleged the exchange operated as an unregistered national securities exchange, broker and clearing agency—and that it offered and sold unregistered securities via its staking service. The company responded by saying that the company had “demonstrated commitment to compliance,” and that the SEC’s “enforcement-only approach” was “hurting America’s economic competitiveness.”

Like with the Bittrex lawsuit, the SEC once again targeted individual digital assets in its complaint against Coinbase—only this time, it called out some of the biggest cryptocurrencies in the space for the first time. That list of allegedly unlawful tokens included Polygon (MATIC), Solana (SOL), Filecoin (FIL), and Cardano (ADA).

The SEC also named Cosmos Hub (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI (COTI) as unregistered securities in the lawsuits.

As a result, the Solana Foundation came out on the defensive, vehemently denying the characterization of Solana as a security. Polygon Labs also put out a statement that said MATIC was “available to a wide group of persons, but only with actions that did not target the U.S. at any time.”

The Solana Foundation disagrees with the characterization of SOL as a security. We welcome the continued engagement of policymakers as constructive partners on regulation to achieve legal clarity on these issues for the thousands of entrepreneurs across the U.S. building in the…

— Solana Foundation (@SolanaFndn) June 10, 2023

The lawsuits caused an uproar in the crypto industry—the attack on Coinbase, in particular. A group of blockchain advocacy groups wrote a letter claiming that the regulator was trying to “usurp Congress’s authority,” and asked the judge overseeing it to dismiss the case.

Wall Street star Cathie Wood said at the time that the SEC was “trying to put [Coinbase and Binance in the same bucket—and they’re not in the same bucket,” claiming that the Coinbase lawsuit was less damning.

This was because Binance had been in the crosshairs of the authorities for some time. And the SEC made that clear with its severe allegations in its lawsuit: it alleged fraud and the comingling of funds.

Most alarmingly, the SEC also alleged that billions of dollars of customer funds went to a bank account for an entity controlled by Zhao.

Binance and Zhao would later go on to settle with the CFTC and more severe criminal charges.

July: Celsius and LBRY catch heat—but Ripple catches a break

Just about every regulator went after crypto lender Celsius in July—one year after it collapsed. Its disgraced ex-CEO Alex Mashinsky was arrested and released on a $40 million bail.

The DOJ, SEC, Federal Trade Commission, and CTFC all hit Mashinksy with lawsuits. In short, Mashinksy allegedly lied and repeatedly misled investors about how well his crypto company was doing and lined his pockets in the process, according to lawsuits. He was arrested but released after agreeing to pay a $40 million personal recognizance bond. His assets have since been frozen as he awaits his trial next year.

Elsewhere, LBRY, Inc., the company behind the eponymous blockchain publishing platform, had to shutter following a long battle with the SEC. The regulator had a problem with the company selling its tokens to fund its project—which it deemed violating securities laws.

The final judgement in SEC vs LBRY is out.

In accordance with the court’s order and our promises, we expect to spend the next several months winding LBRY Inc. down entirely.

As to what happens to LBRY from here, well, that’s up to you. pic.twitter.com/cU8O3nATT6

— LBRY 🚀 (@LBRYcom) July 11, 2023

But the “war on crypto” wasn’t completely one-sided, and July marked the first time that the SEC suffered a significant setback in its attempts to “regulate through enforcement.”

Ripple, the crypto payments startup whose founders also created the XRP cryptocurrency—still to this day one of the biggest digital assets around by market cap—scored a significant win against the SEC on July 13.

Following a massive 2020 $1.3 billion lawsuit alleging that the fintech firm had misled investors and sold unregistered securities in the form of XRP back in 2020, a judge sided with the company. Federal district judge Analisa Torres ruled that programmatic sales of XRP to retail investors—that is, Ripple’s sales of XRP on cryptocurrency exchanges to the average crypto user—did not qualify as securities transactions.

The judge also ruled, however, that the $728 million-worth of contracts for institutional sales did constitute unregistered securities sales, so Ripple isn’t completely off the hook. Nevertheless, the company and XRP holders around the world celebrated the win just the same. Major cryptocurrency that had previously halted trading for XRP relisted the asset, and the coin exploded in value.

Ripple’s General Counsel Stu Alderoty said at the time that he expected U.S. banks to go back to using the fintech firm’s On-Demand Liquidity (ODL) product.

August: Grayscale scores against the SEC

A month later, the SEC once again was defeated in court when faced up against a crypto firm—an unfamiliar posture for the regulator.

Grayscale scored a win against the SEC in a shocking development of its long and drawn out battle with the regulator.

The crypto fund manager had applied to the SEC to turn its Bitcoin Trust into an exchange-traded fund (ETF) but was denied. Grayscale then sued the SEC in 2022.

The court took Grayscale’s side in late August when a U.S. Court of Appeals for the D.C. Circuit judge overturned the SEC’s decision to block its ETF ambitions. The judge said that the denial of Grayscale’s proposal was “arbitrary and capricious” because the regulator had already approved similar products—crypto futures ETFs.

Crypto markets interpreted the ruling as positive and the price of Bitcoin shot up. Analysts told Decrypt that the move would help approval of a long-awaited Bitcoin ETF in the long-run.

Meanwhile, Bittrex agreed to pay $24 million in fines to settle its case with the SEC for allegedly selling unregistered securities. It neither admitted nor denied the charges.

September: Binance bites back

Binance and its boss CZ bit back at the SEC in September, asking for June’s lawsuit to be dismissed. The short of it, Binance’s legal representatives argued, was that the SEC never gave clear guidelines for the crypto sector and as a result, was overstepping its regulatory authority.

The exchange also argued that the regulator had sought to “enlarge its jurisdiction globally.” The SEC’s lawsuit argued that American customers were using Binance’s global service—despite not being allowed to.

Wall Street’s top regulator “often argues that such companies, regardless of their location, must comply with U.S. securities laws if they are serving U.S. residents or their activities have significant effects on U.S. markets,” former CFTC trial attorney Braden Perry told Decrypt.

October: Genesis saga continues

The New York Attorney General’s office in October filed a lawsuit against Genesis Global Capital, Gemini Trust, and Digital Currency Group (DCG), alleging that the three companies “lied to investors and tried to hide more than a billion dollars in losses.”

New York Attorney General Letitia James said in a statement that “middle-class investors who suffered as a result” due to the three companies allegedly defrauding 232,000 customers for over $1 billion.

A DCG spokesperson told Decrypt that they would fight the claims.

November: Bye-bye, Zhao

The war on crypto reached its climax last month when the U.S. government at last convicted two of crypto’s biggest personalities: FTX founder Sam Bankman-Fried, and Binance founder Changpeng Zhao.

On November 3, a jury convicted Bankman-Fried of seven fraud and conspiracy charges. This concluded the criminal saga connected to colossal collapse of the FTX mega brand—though Bankman-Fried’s lawyers have vowed to appeal the verdict and continue to fight the charges.

Then, only weeks later, Binance CEO Zhao agreed to step down from his role at his crypto company as part of a settlement with the U.S. Department of Justice, following a years-long investigation. He agreed to pay $4.3 billion in fines and pleaded guilty to money laundering charges.

Right around the same time, the SEC went after Kraken for the second time this year, alleging that the San Francisco-based crypto exchange commingled customer assets with company funds—even paying some bills from an account meant for clients.

The regulator also said Kraken sold unregistered securities—something the exchange vehemently denied—and put investors’ funds at risk. Kraken said it would “defend its position.”

December:

After a hard year for Binance’s now ex-boss Zhao, a U.S. judge banned the disgraced crypto mogul from leaving the country, saying that he posed “too great a flight risk” due to his “enormous wealth and property abroad.” His sentencing will take place next year.

But what happens next? Not all are saying that 2024 will continue to be difficult. Blockchain Association CEO Kristin Smith said that it was likely the crypto sphere was “turning the corner on core regulatory issues.”

“The FTX verdict and the conclusion of the DOJ’s case against Binance should clear some of the air in Washington,” she said.

“2024 will be a turnaround year for the industry,” she added.

Stay on top of crypto news, get daily updates in your inbox.

[ad_1]

Source link

[ad_2]