Spot Bitcoin ETF Approval Could Come in January Say Analysts

[ad_1]

The likelihood of the Securities and Exchange Commission approving a spot-based Bitcoin exchange-traded fund is increasing, according to industry experts. The approval of America’s first Ethereum futures ETFs this week has boosted their confidence.

The crypto industry and ETF analysis are more confident than ever that the SEC will approve a spot Bitcoin product in the near future.

Bitcoin ETF Odds Increasing

On October 4, crypto trader and analyst Alex Krüger said that his spot Bitcoin ETF approval odds were 70%. He added that it would likely be in January, and the event was tradable.

“Crypto traders are ‘Sell the News’ professionals,” he said before adding, “Selling the news requires front-running.”

The SEC has been vehemently against spot-based crypto derivatives that need to hold the underlying asset. Instead, it has only approved those based on futures contracts, citing volatility and market manipulation.

ETF store President Nate Geraci echoed the sentiment, stating:

“This is why you launch Ether futures ETF even though you know spot ETFs will likely be approved in the not-too-distant future.”

Following Ripple’s latest partial victory against the SEC this week, “Crypto Rover” said:

“The SEC now has no valid arguments to deny a spot Bitcoin ETF. They will be forced to accept it.”

The “Bitcoin Therapist” concurred, adding:

“I think this is largely true. Except they will run with the crypto fraud scapegoat for as long as the narrative allows them. In the end, it will be approved and will see trillions of dollars flow through it,”

According to “Mister Crypto,” the former director of BlackRock said that the SEC would approve spot Bitcoin ETFs within three to six months. He also said there could be capital inflows of up to $200 billion.

A Large ETF Queue

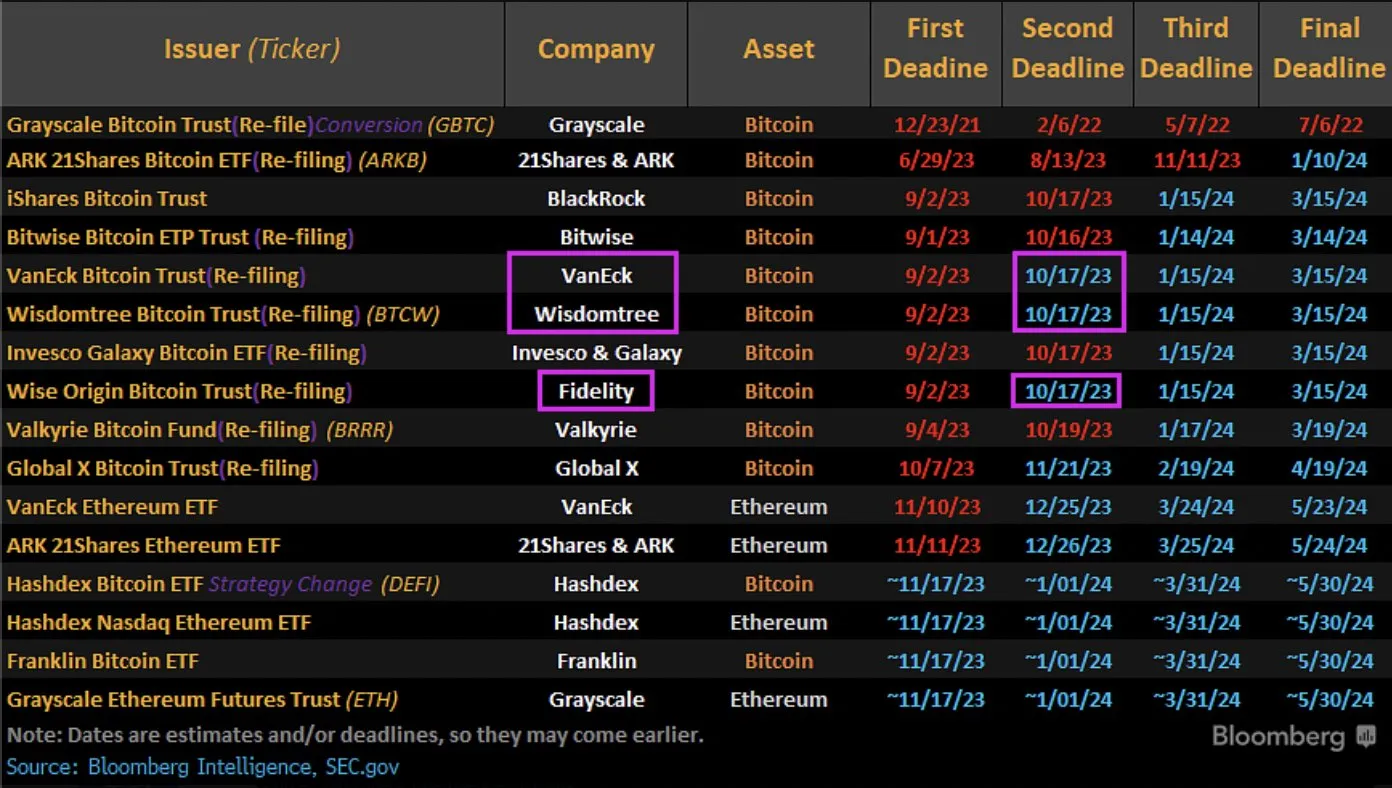

On October 4, Bloomberg ETF expert Eric Balchunas posted the latest update in the long list of pending applications.

He said that October 13 is the deadline for the SEC to appeal the Grayscale ruling. Moreover, “all spot filings are basically delayed until January 3,” he added.

The SEC is actively engaging with ETF issuers to fine-tune their filings, said Balchunas.

The second deadline for VanEck, WisdomTree, and Fidelity is on October 17, and it is highly likely that they will all be postponed until January.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link