Will Shiba Inu (SHIB) Token Burn Spark Price Rebound?

[ad_1]

Shiba Inu (SHIB) price tumbled toward $0.000007 on Monday as sell-pressure intensified across the memecoin markets. However, as the Shibarium Layer-2 (L2) network usage steadies, on-chain data reveals that the SHIB token burn rate has also increased. Will it impact Shiba Inu prices positively amid the prevailing bearish sentiment?

Ahead of the Shibarium L2 Network launch, the Shiba Inu team stated how it could “significantly impact the ecosystem by reducing the supply of SHIB. Recent on-chain data trends suggest that assertion now appears to have been set in motion.

But will it impact SHIB prices significantly?

Shibarium Network Transactions Have Increased by 175% This Month

After a shaky start greeted by the market FUD and network problems, Shibarium L2 Network is now experiencing steady growth.

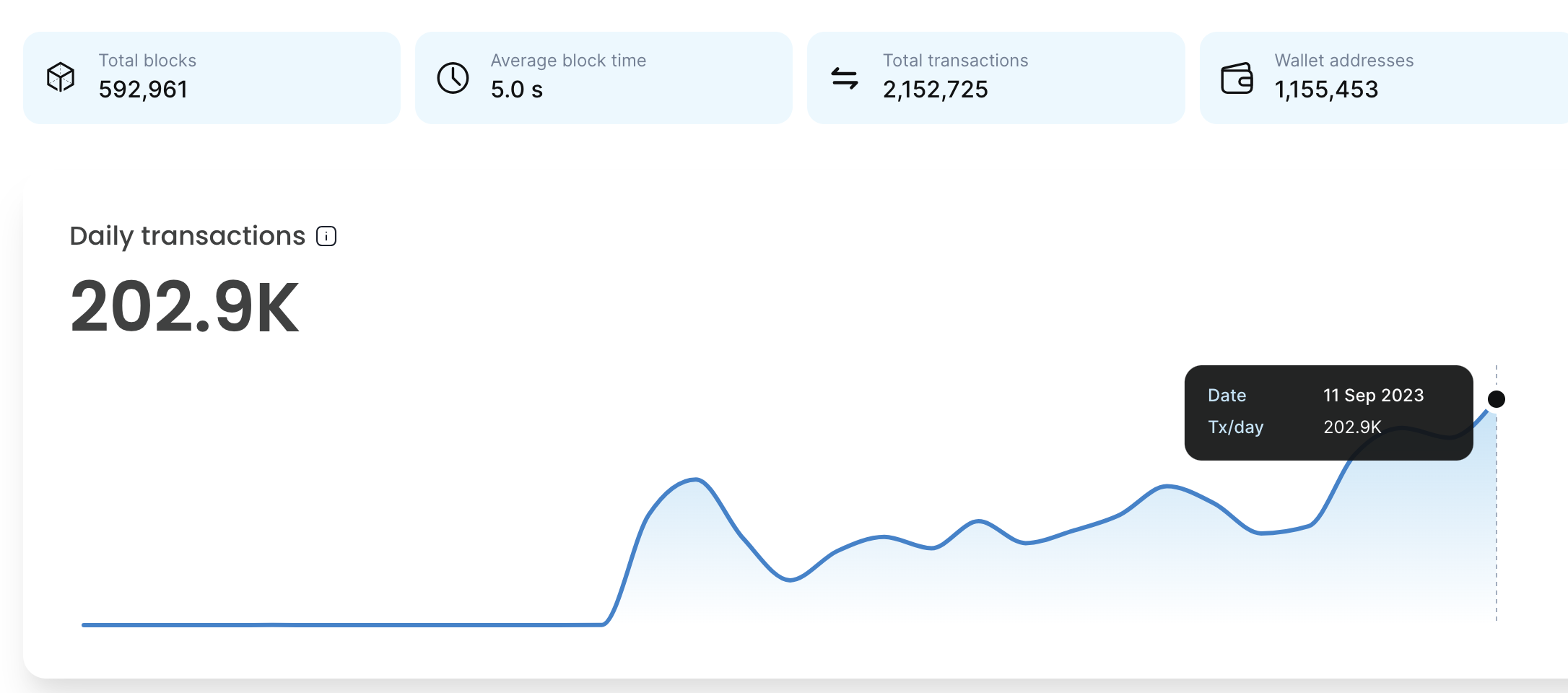

On-chain data from the official ShibariumScan tracker tool shows that only 73,600 transactions were processed on September 1. But it has grown consistently since then, hitting 202,900 transactions on September 11.

Notably, this represents an eye-popping 175% growth in network activity in less than two weeks.

A Steady rise in Daily transaction count is a positive signal for several reasons. Firstly, it indicates broader adoption and growing demand for the service and tokens hosted on the network.

And more importantly, it indicates the increased efficiency and stability of the Shibarium network itself. Going by the pre-launch assertions made by the Shiba Inu team, if this uptrend persists, it could accelerate the SHIB burn rate. And if matched by demand, it could ultimately trigger an increase in SHIB prices.

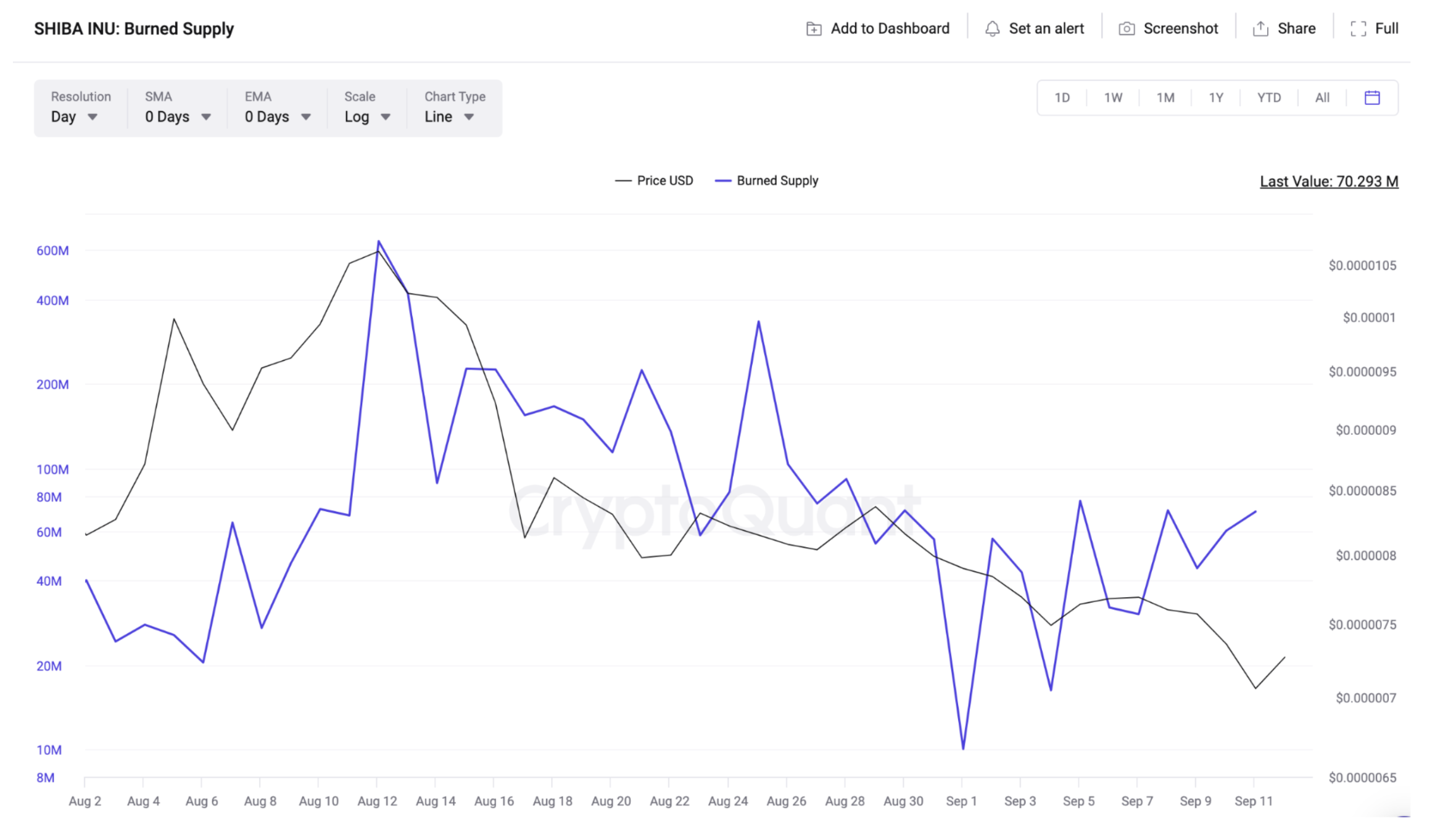

SHIB Burn Rate Has Increased In Correlation to Shibarium Network Activity

Seemingly, in confirmation of the Shiba Inu team’s assertion, the SHIB token burn rate has also increased significantly this month. According to data from CryptoQuant, Shiba Inu’s daily token burn count had slid to a two-month low of 10.06 million SHIB on September 1. But as the Shibarium network activity recovered, the burn rate has since increased by 700%, reaching 70.3 million at the close of September 11.

A token burn is a mechanism that permanently removes a certain quantity of a cryptocurrency from circulation. It typically involves sending the tokens to an address from which they cannot be spent or retrieved.

By reducing Shiba Inu’s total circulating supply, a persistent increase in token burn rate can drive up prices if demand holds steady.

The correlation between the Shibarium traction growth and the recent increase in SHIB burn rate between Sept 1 and Sept 12 establishes a connection between both trends.

If this assertion holds true, it could reaffirm investors’ confidence in the Shiba Inu project and help shore up SHIB price support levels amid the ongoing bearish trend.

SHIB Price Prediction: The Bulls Could Defend the $0.000007 Support

The vital on-chain indicators analyzed above suggest that SHIB could find sufficient demand for the $0.000007 support territory.

The In/Out of Money Around Price data, which outlines the purchase price distribution of the current Shiba Inu holders, also vividly illustrates this.

It highlights that 57,940 million investors had bought 19.8 trillion SHIB tokens at the maximum price of $0.000007. If the token burn rate rises, they could hold their positions and trigger an early SHIB price rebound.

But if the bears can push that support level aside, Shiba Inu price could drop further toward $0.000005

But if the memecoin market FUD subsides, the bulls could potentially force a major upswing toward $0.000010. However, 429,150 addresses had bought 301.5 trillion SHIB at the minimum price of $0.000008. And if they chose to sell, Shiba Inu price could drop again.

But if that resistance level gives way, Shiba Inu price could promptly reclaim $0.000010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link