Ripple (XRP) Price Count Suggests Bottom is Close

[ad_1]

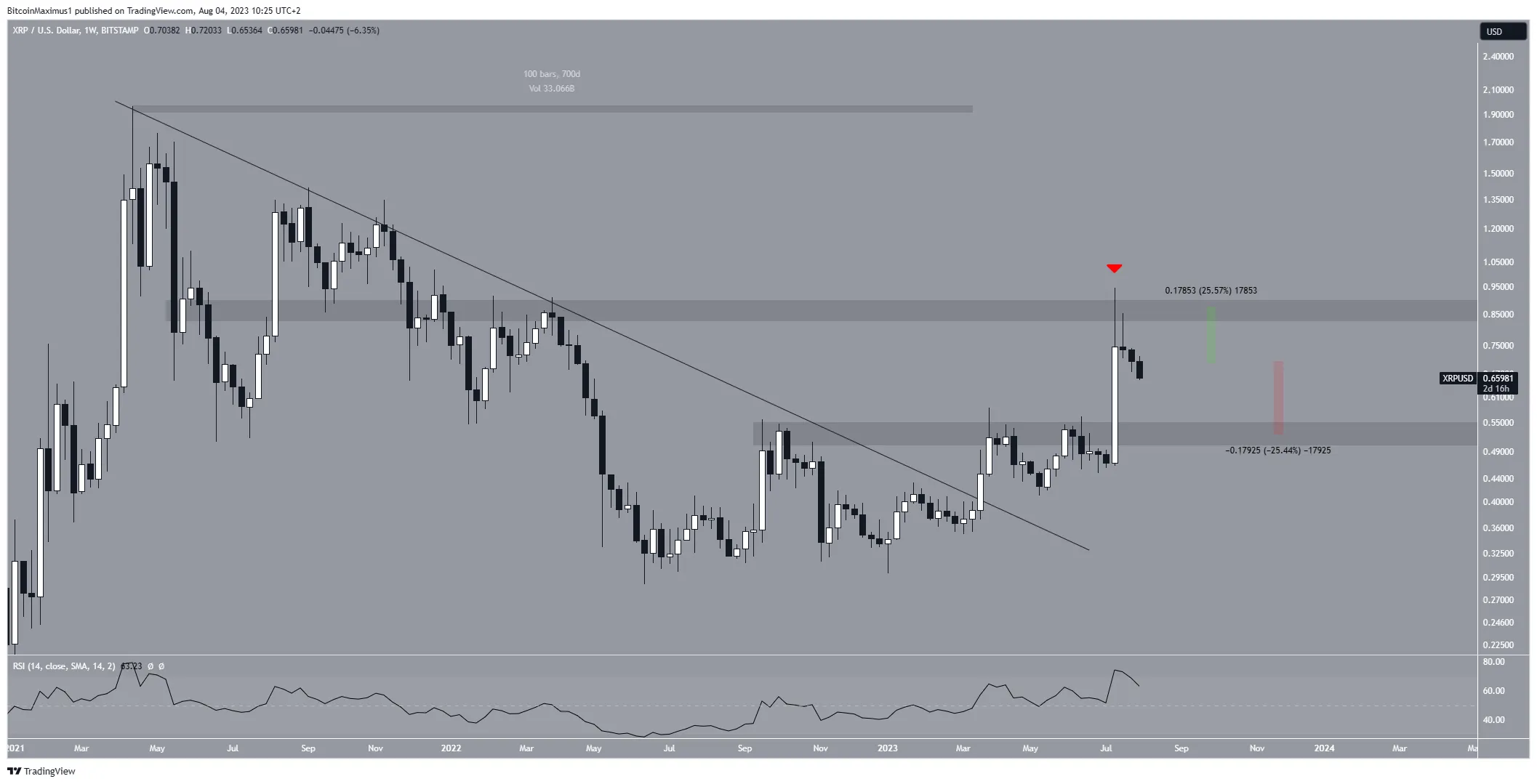

Ripple’s XRP price experienced a breakout from a 700-day resistance line, resulting in a yearly high of $0.94. However, the price has declined since then, confirming the significance of the $0.90 resistance area.

The long-term trend remains bullish due to the successful breakout. While the short-term trend is still undetermined, it suggests that a bottom will be reached soon if it has not been reached already.

Ripple Price Gradually Drops After Rejection From Resistance

The analysis of XRP on the weekly time frame shows a positive outlook. This is mainly due to the breakout from a descending resistance line that had been in place for 700 days. Breakouts from such long-term patterns often lead to significant movements in the opposite direction.

News on the Ripple front remains positive. The XRP ledger adoption spiked internationally after Ripple’s historic win against the SEC, which determined that XRP is not a security.

Following the breakout, XRP successfully surpassed the $0.54 horizontal resistance area, forming a bullish candlestick. It then proceeded to reach the next resistance level at $0.90 but faced rejection within the same week (red icon).

Currently, XRP is trading very close to the midpoint between these two levels, since it is roughly 25% away from both the resistance and support areas.

The weekly Relative Strength Index (RSI) further supports the likelihood of a continued increase. Traders use the RSI as a momentum indicator to assess whether a market is overbought or oversold, helping them decide whether to accumulate or sell an asset.

Since the RSI reading is above 50 and rising, it indicates a bullish trend, suggesting that bulls still maintain an advantage in the market.

XRP Price Prediction: Is the Correction Complete?

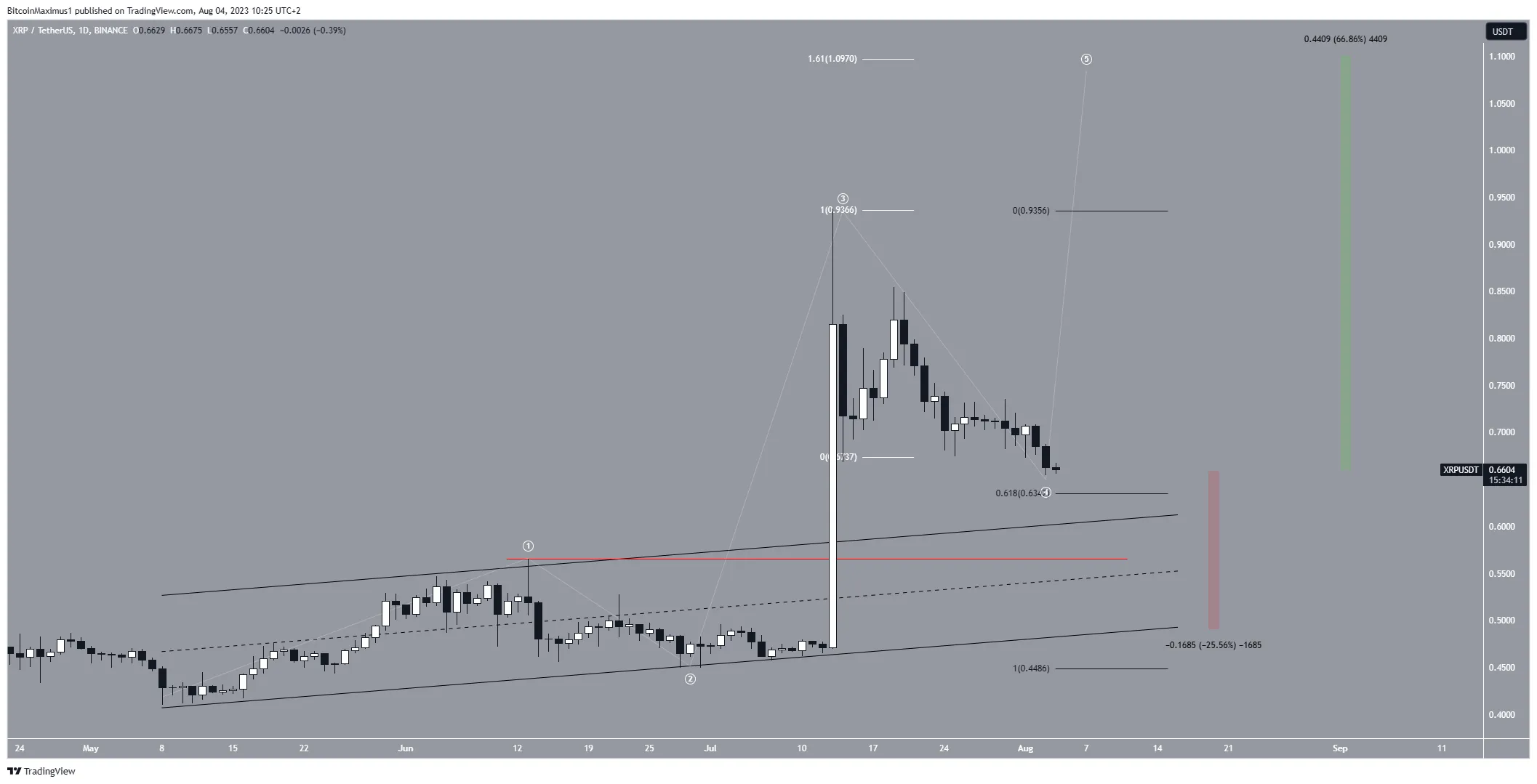

The short-term six-hour time frame’s technical analysis also indicates a bullish outlook for XRP. The primary reason for this bullish sentiment is the wave count.

Technical analysts use the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, enabling them to determine the direction of a trend.

Based on the most likely wave count, the current XRP price is in wave four of a five-wave uptrend (white). This suggests that the rate of increase is expected to accelerate towards $1.10 after the corrective phase is completed.

The target is found using the 1.61 external retracement on wave four and is 66% away from the current price.

If a bottom has not been reached yet, most probable area for it is around $0.64, which is defined by a confluence of support levels. These support levels include the 0.618 Fibonacci retracement support level and the previous ascending parallel channel.

A strong bounce at this level will confirm the beginning of wave five. The price has nearly reached this level, so a bounce would confirm the bottom.

Despite the bullish prediction for XRP’s price, a drop below the wave one high at $0.56 (red line) would indicate a bearish trend. In such a scenario, the XRP price would likely decline to the channel’s support line, currently at $0.50. Which would amount to a drop of 25%.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link