Banks’ Privacy Breaches Push Users to DeFi, Experts Warn

[ad_1]

Some banks have quietly updated their policies to enable the monitoring of customers’ social media profiles. The change poses a severe threat to the privacy of bank users and provides yet another reason to consider decentralized alternatives.

According to a July 23 report in the Daily Telegraph, major banks have changed their privacy policies. Britain’s biggest high street lenders and several others have hidden language in their privacy policies allowing the culling of information from social media accounts. In the past, banks had claimed to avoid such checks on sites like Facebook and Twitter.

High street banks now face mounting pressure to disclose the checks they conduct on customers. Particularly after Nigel Farage, the former UK Independence Party (UKIP) leader, discovered that the exclusive bank Coutts closed his accounts. The reason? The pro-Brexit maverick held views unaligned with the bank’s values.

A dossier put together on Farage included examples of his posts on Twitter. Farage is a controversial figure in the UK, having spearheaded the years-long campaign for Britain to leave the EU.

The UK government is looking at three more banks, Metro Bank, Yorkshire Building Society, and American Express, for alleged account closures based on customers’ political views.

However, bank account closures aren’t always because of political reasons. Users of the crypto exchange Coinbase have reported that Bank of America has shut down their accounts. Presumably over an aversion to risky behavior.

The revelation that banks are surveilling their customers give some a further reason to consider decentralized finance (DeFi) protocols. From the point of view of privacy, they may find DeFi a better option.

DeFi is built on blockchain and is designed to be a “trustless” system. It relies on smart contracts to automate and enforce financial transactions and agreements without needing a trusted intermediary.

DeFi Is Censorship-Resistant, With More Private Options

DeFi is also designed to be censorship-resistant. Transactions and interactions within DeFi are typically permissionless, meaning users can participate without needing approval or intervention from any central entity.

Multiple sources told BeInCrypto they were concerned about the banks’ policy changes. They were candid about the fact that these moves spotlight the benefits of DeFi.

Elena Nadolinski, CEO of the Iron Fish Foundation, believes recent revelations boost DeFi’s path to a decentralized, inclusive, and privacy-focused financial future.

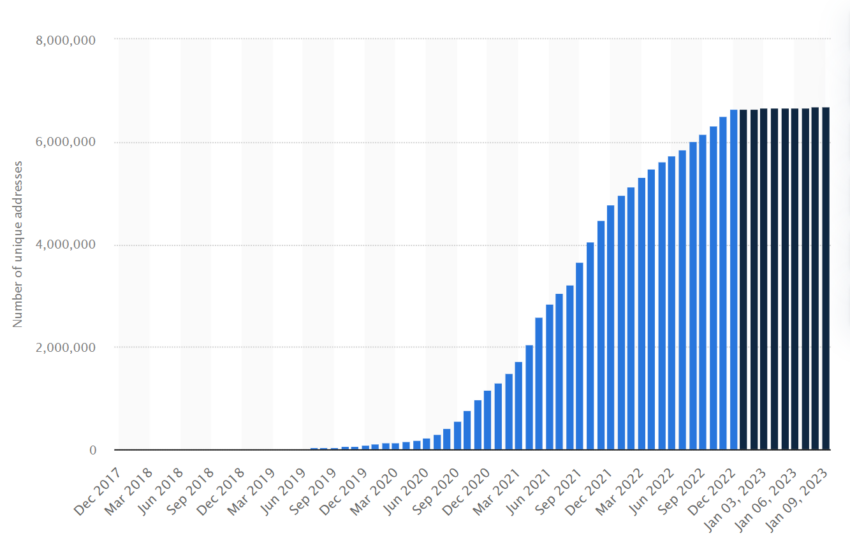

“People increasingly use DeFi as an alternative, or supplementary, to their banking needs. Transacting in USD, and even earning yield in USD (or assets pegged to USD) has now become incredibly easy. Even for people outside the United States,” Nadolinski said.

However, as decentralized finance grows, so does the pressure for the industry to conform to financial norms. DeFi is currently facing increasing pressures to clamp down on money laundering and behave like traditional banks.

In fact, a new bipartisan bill in the US would require large investors in DeFi protocols to take responsibility for financial monitoring. Under this legislation, you will not be able to avoid responsibility for money laundering just because you are an investor rather than the head of a fund or exchange.

US officials have repeatedly called out DeFi for allowing criminals to launder their illegal gains.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link