Best Crypto to Buy Now May 29 – Ethereum, PancakeSwap, DeeLance

[ad_1]

Join Our Telegram channel to stay up to date on breaking news coverage

Following the last best crypto to buy guide, the global crypto market cap has reached $1.16 trillion. This notable milestone signifies a 2.09% increase within 24 hours.

Market Cap Charts

The rise in the market cap might be due to the new agreement reached by the American President and House Speaker Kevin Mccarthy. Both parties decided to increase The United States debt ceiling. This decision heightened the investors’ enthusiasm for volatile assets. As a result, Bitcoin rose above $28,000, and Ethereum followed by breaking through $1,900.

As enthusiasts delve into cryptocurrencies, they encounter a vibrant ecosystem fueled by innovation, DeFi protocols, NFTs, and other groundbreaking concepts. These factors contribute to digital assets’ ever-expanding utility and adoption, attracting institutional investors and individual traders.

To make informed decisions, investors conduct thorough research, considering various factors like project fundamentals, technological advancements, and potential partnerships. They recognise that cryptocurrencies can experience rapid price fluctuations. Regulatory changes, global economic events, and investor sentiment drive these changes. Consequently, it is crucial to remain vigilant and adaptable while navigating the dynamic crypto market.

New projects offer unique solutions and investment opportunities as the crypto industry evolves. By staying updated with the latest news, market analysis, and expert insights, investors can position themselves to identify the best crypto to buy now. Besides, they can leverage their knowledge and risk appetite to make well-informed investment decisions.

The Top Crypto Projects to Invest In Today

Identifying promising investment opportunities can be challenging in the dynamic world of cryptocurrencies. However, for those seeking the best crypto to buy now, today presents an opportune moment to explore the market. These numerous digital assets show remarkable potential for growth and profitability.

1. Ethereum (ETH)

Ethereum was launched in 2015, building upon Bitcoin’s groundbreaking innovations but with significant distinctions. It allows individuals to utilise digital currency without relying on payment providers or banks like Bitcoin. However, Ethereum’s differentiating factor lies in its programmability, enabling the creation and deployment of decentralised applications on its network.

Bitcoin empowers individuals to exchange essential messages regarding their perceptions of value, establishing value without the need for centralised authority. Ethereum expands on this concept by enabling the composition of diverse programs or contracts, surpassing the boundaries of mere messaging. The possibilities for creating and agreeing upon arrangements on the Ethereum network are boundless, fostering a platform for substantial innovation.

While Bitcoin primarily serves as a payment network, Ethereum is a versatile marketplace. It offers several financial services, games, social networks, and other applications that uphold user privacy and prevent censorship.

No single entity controls Ethereum. The decentralised community’s active participation and cooperation bring Ethereum into existence. Instead of relying on individual servers and cloud systems owned by major internet providers, Ethereum utilises nodes that volunteers operate. These nodes are computers equipped with copies of the Ethereum blockchain data.

Volunteers, comprising individuals and businesses across the globe, manage these distributed nodes, providing resilience to Ethereum’s network infrastructure. Consequently, Ethereum becomes significantly less susceptible to hacks or shutdowns. Since its inception in 2015, Ethereum has maintained uninterrupted operation, never experiencing downtime. The Ethereum network boasts thousands of individual nodes operating worldwide. This characteristic establishes Ethereum as one of the most decentralised cryptocurrencies, with only Bitcoin surpassing it in decentralisation. Ethereum is the best crypto to buy now and is available on eToro.

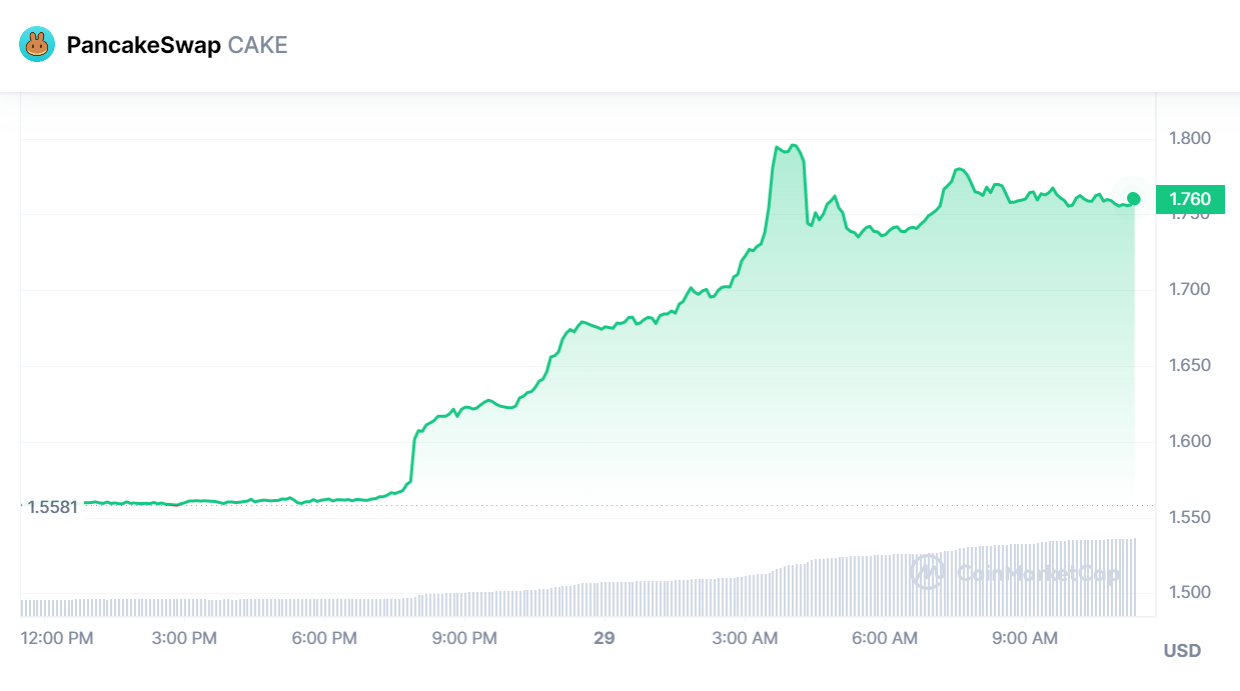

2. PancakeSwap (CAKE)

PancakeSwap is a major decentralised exchange (DEX) operating on the Binance Smart Chain (BSC). It allows users to swap, stake, and farm various cryptocurrencies. In recent times, PancakeSwap has witnessed significant developments and achieved impressive statistics. These solidify its position as the best crypto to buy now in the decentralised finance (DeFi) space.

One notable development is the introduction of PancakeSwap V2, which brought several improvements to the platform. The upgrade enhanced the user interface, expanded trading features, and introduced a new farming mechanism called “Flip.” The Flip feature allows users to earn additional tokens by staking CAKE tokens. Introducing V2 brought excitement to the PancakeSwap community, attracting new users and increasing overall liquidity.

Furthermore, PancakeSwap has been actively expanding its ecosystem through partnerships and collaborations. It has integrated with various projects and protocols, enabling seamless interoperability and providing users with diverse assets to trade. These partnerships have bolstered PancakeSwap’s credibility and popularity, attracting retail and institutional investors.

The transaction volume on PancakeSwap has also witnessed a remarkable increase. With lower fees than other Ethereum-based DEXs, PancakeSwap has become an attractive alternative for traders seeking efficient and cost-effective transactions. The high transaction volume further contributes to the platform’s liquidity, making it a vibrant and bustling ecosystem.

PancakeSwap’s native token, CAKE, has experienced substantial price appreciation, reflecting its growing demand and utility within the platform. The token serves multiple purposes, such as governance voting rights, staking, and participation in token sales. CAKE holders can also earn passive income through yield farming and liquidity provision.

??️ We’re on the right track to ultrasound CAKE! ?️Now we need our community to vote on the CAKE Farm emission reduction:

? What we propose:

? Lower v3 BNB Chain emissions from 0.75 CAKE/block? Remove v2 Farm emissions for BTC, ETH & BNB pairs

? Why?

? v3 doesn’t need… pic.twitter.com/XpAZyzOZCe

— PancakeSwap?Ev3ryone’s Favourite D3X (@PancakeSwap) May 29, 2023

To ensure the security and reliability of the platform, PancakeSwap has actively taken measures to address potential vulnerabilities. It has conducted extensive audits of its smart contracts, collaborated with renowned security firms, and implemented robust security protocols. These efforts safeguard users’ funds and maintain the platform’s integrity.

Looking ahead, PancakeSwap continues to innovate and introduce new features to enhance user experience and expand its offerings. With the Binance Smart Chain gaining traction as a famous blockchain ecosystem, PancakeSwap is well-positioned to capitalise on its growing user base and solidify its position as one of the leading DEXs in the DeFi landscape.

3. DeeLance (DLANCE)

DeeLance, a decentralised freelancing platform, enables buyers and sellers to engage in a dynamic environment. The ecosystem utilises its native token, DLANCE, to facilitate transactions, platform fees, and other purposes.

The project identified the shortcomings and drawbacks associated with conventional freelancing platforms. DeeLance, encompassing an NFT marketplace, Metaverse, and a Recruitment platform, seeks to streamline the experience for buyers and sellers.

Buyers who have undergone the arduous hiring process and need help finding the ideal candidate can now rely on DeeLance. It will help assess employees’ reputations and determine their suitability. The platform equips users with the necessary tools to streamline this process effectively.

On the other hand, freelancers have often found themselves burdened with exorbitant 20% commissions imposed by Upwork, Fiverr, etc. However, DLANCE addresses this issue by implementing a modest 10% fee for freelancers. Buyers are subject to a mere 2% fee, over 3% less than other platforms.

DeeLance represents the future of freelancing, and its presale is currently underway. You should promptly acquire DLANCE tokens to capitalise on the platform’s potential and benefits. Therefore, it is the best crypto to buy now.

The potential for explosive growth in DeeLance is evident when freelancers and recruiters use it over other websites. DeeLance outperforms its competitors by offering many advantages within a transparent and secure environment. You should take advantage of the current low price of $DLANCE and observe its rapid ascent in weeks.

4. Sui (SUI)

Sui’s tokenomics comprises three essential components that align SUI token holders’ incentives with Sui’s validators. The Proof-of-Stake Mechanism in Sui guarantees this alignment, ensuring tokenholders’ incentives are in sync with the validators. Its Gas Mechanism ensures that the network charges users low and stable gas fees, regardless of the network’s activity demand.

This mechanism effectively maintains affordability and stability for users. Furthermore, Sui’s Storage Fund ensures accurate pricing for data storage. This feature prevents future network users from being burdened by the costs associated with data stored today.

Sui achieves several important outcomes through its gas pricing mechanism. It delivers users low and predictable transaction fees and incentivises validators to optimise transaction processing. It also prevents spam and denial of service attacks.

The project employs a network-wide reference price determined by validators through a survey at the beginning of each epoch. This strategy ensures predictable transaction fees. Validators state their minimum acceptable price for processing transactions, and the protocol then orders these prices. A reference price is selected based on the consensus of a quorum of validators required to maintain network operations efficiently.

Validators are strongly motivated to propose reasonable prices because of the Tallying Rule utilised by the network. The measure determines which validators process transactions at the current gas price. Validators evaluate each other’s performance during the epoch, which establishes a multiplier affecting the stake rewards of other validators. If a validator fails to meet expectations, they can invoke the Tallying Rule to reduce that validator’s tips. This mechanism enforces community standards and encourages validators to adhere to the reference gas price.

Unlike gas fees, Sui’s storage fees depend on governance proposals aligning with the cost of off-chain data storage. The expenses associated with off-chain storage decrease over time. Likewise, governance proposals are introduced to adjust Sui’s on-chain storage fees, ensuring they are consistent with the new target price.

On the network, SUI tokens fulfil four essential roles. Validators stake SUI tokens to safeguard the network and earn stake rewards. Users utilise SUI tokens to cover gas fees for executing transactions and performing various operations. SUI tokens are the intrinsic asset facilitating on-chain transactions, forming the foundation of the entire Sui economy. Holders of SUI tokens possess the privilege to engage in forthcoming governance activities. Additionally, the maximum supply of SUI tokens is limited to 10 billion.

5. Neo (NEO)

Initially launched in 2014 as AntShares, Neo rebranded in 2017 to create a smart economy. It planned to integrate blockchain technology with digital assets, smart contracts, and decentralised applications (dApps).

Neo has made substantial progress in recent years, both in terms of technological advancements and market adoption. One of its notable developments is the implementation of Neo3, the latest version of its blockchain protocol. Neo3 brings several improvements, including enhanced performance, scalability, and security. With a focus on optimising resource allocation and enabling faster processing, Neo3 has the potential to support large-scale enterprise applications.

In addition to its technical upgrades, Neo has actively pursued partnerships and collaborations to expand its ecosystem. The platform has joined forces with various organisations, including leading blockchain projects, academic institutions, and industry players. These partnerships have fostered innovation, research, and adoption of Neo’s blockchain technology across different sectors.

Neo has also made strides in promoting developer engagement and supporting the growth of dApps on its platform. The Neo Virtual Machine enables developers to build and deploy smart contracts using C#, Java, and Python programming languages. This flexibility appeals to a broader developer community and encourages creating of diverse, decentralised applications.

From a market perspective, Neo has demonstrated resilience and consistent growth. Neo’s market capitalisation is around $780 million, making it the best crypto to buy now by market cap. Its native token, NEO, is a utility token for network operations. Also, it is a staking asset for generating passive income through the Neo ecosystem.

Neo’s community-driven governance model also sets it apart from other cryptocurrencies. NEO holders can participate in decision-making by voting on proposals and shaping the platform’s future direction. This democratic approach fosters transparency and inclusivity, ensuring the community’s interests are considered.

Moreover, Neo has made significant progress in regulatory compliance. The project has actively worked with authorities to ensure adherence to relevant regulations. Neo has been recognised as one of the compliant blockchain platforms in multiple jurisdictions. This regulatory compliance enables Neo to foster partnerships with traditional institutions and explore opportunities for blockchain integration in various industries.

The team behind NEO is actively developing NeoFS. It is a decentralised storage solution that aims to provide secure and scalable file storage for dApps. This addition to the ecosystem will enhance its infrastructure and offer developers a comprehensive suite of tools for building dApps. The best crypto to buy now is listed on eToro.

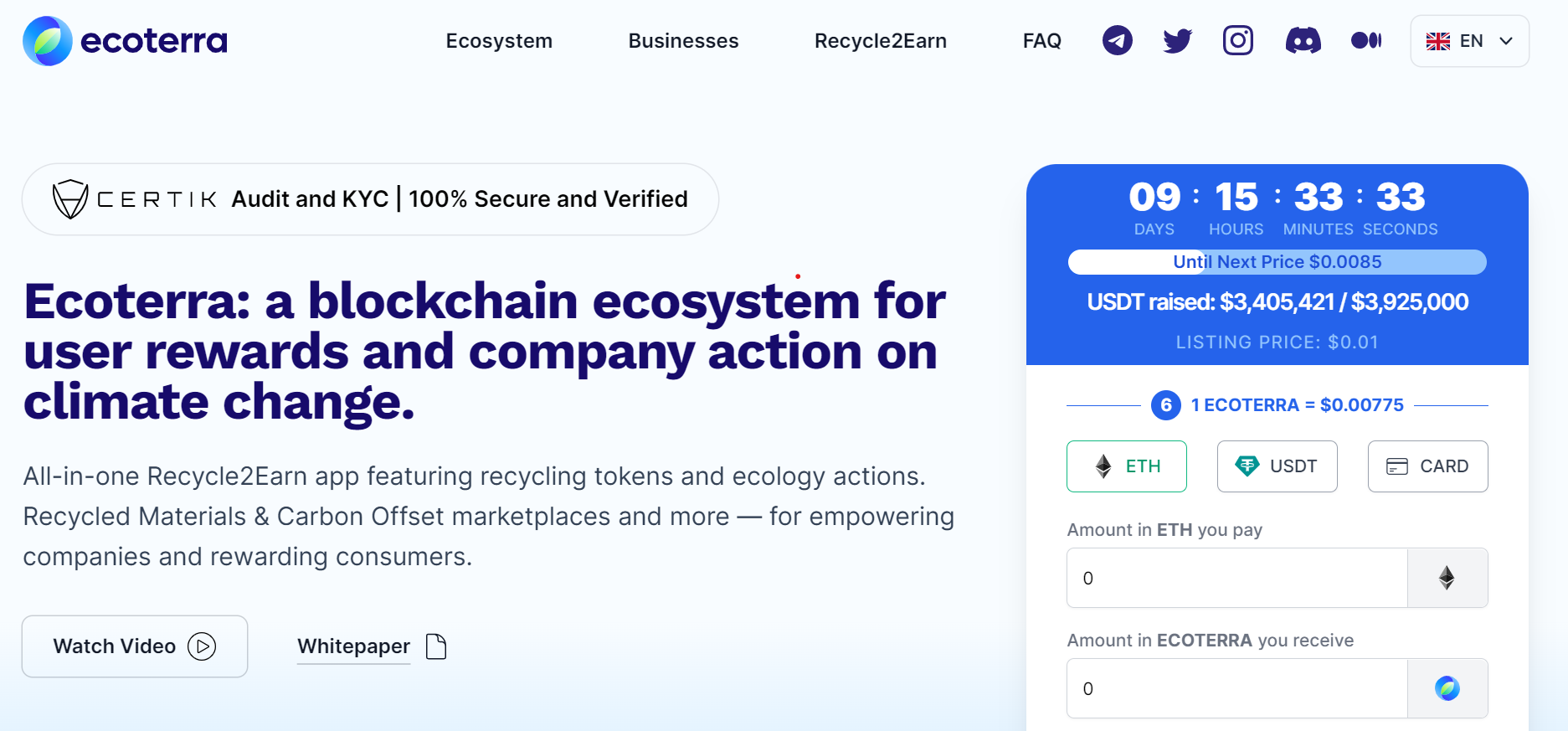

6. Ecoterra (ECOTERRA)

Ecoterra focuses on raising awareness regarding the irreversible changes caused by people’s daily activities and habits. The team behind Ecoterra shares a remarkable common goal amidst the prevailing environmental issues. They aim to promote recycling to combat global warming and climate change. To accomplish this, the company has devised multiple projects aimed at incentivising users to participate in recycling practices actively.

These initiatives intend to encourage individuals to tackle environmental challenges such as air and plastic pollution, food waste, and deforestation. All of these pose significant threats to the well-being of humanity. Ecoterra is a company that raises awareness about the irreversible changes people contribute to through their daily activities and habits.

Air and plastic pollution, food waste, deforestation, and ocean acidification are just a few of the environmental issues the world is currently dealing with. Each one tends to threaten everyone’s lives. In the eye of the current environmental problems, the team behind ecoterra has one remarkable common goal: to encourage recycling to fight global warming and climate change. To do that, the company has developed various projects to incentivise users to recycle.

Ecoterra users can receive points based on their recycling activities. All information regarding their progress will be displayed in the “Impact Profile” section. Companies can also team up with ecoterra to incentivise users to recycle. This way, ecoterra, along with its partners, can impact the way climate change is evolving.

Another great project developed by ecoterra is the recycled materials marketplace. There, users can connect with worldwide companies to purchase various recycled materials. They can pay for the products with ECOTERRA tokens, cryptocurrencies, or fiat currencies. The team behind ecoterra has made sure that every project it launches can positively impact the environment. They can reduce the effects of global warming and climate change along with numerous incentivised users and multiple worldwide companies.

Ecoterra is actively developing the carbon offset marketplace as one of its key features. They are working on enabling users to purchase carbon offsets through the app directly. One of Ecoterra’s partners, VERA, will verify these carbon offsets thoroughly. Like Recycle2Earn and the recycled materials marketplace, users’ activity in the carbon offset marketplace will be visible on their Impact Profile.

The project is currently in the process of app preparation to facilitate user registration. This step will allow users to soon recycle through the Recycle2Earn feature, earning ECOTERRA tokens.

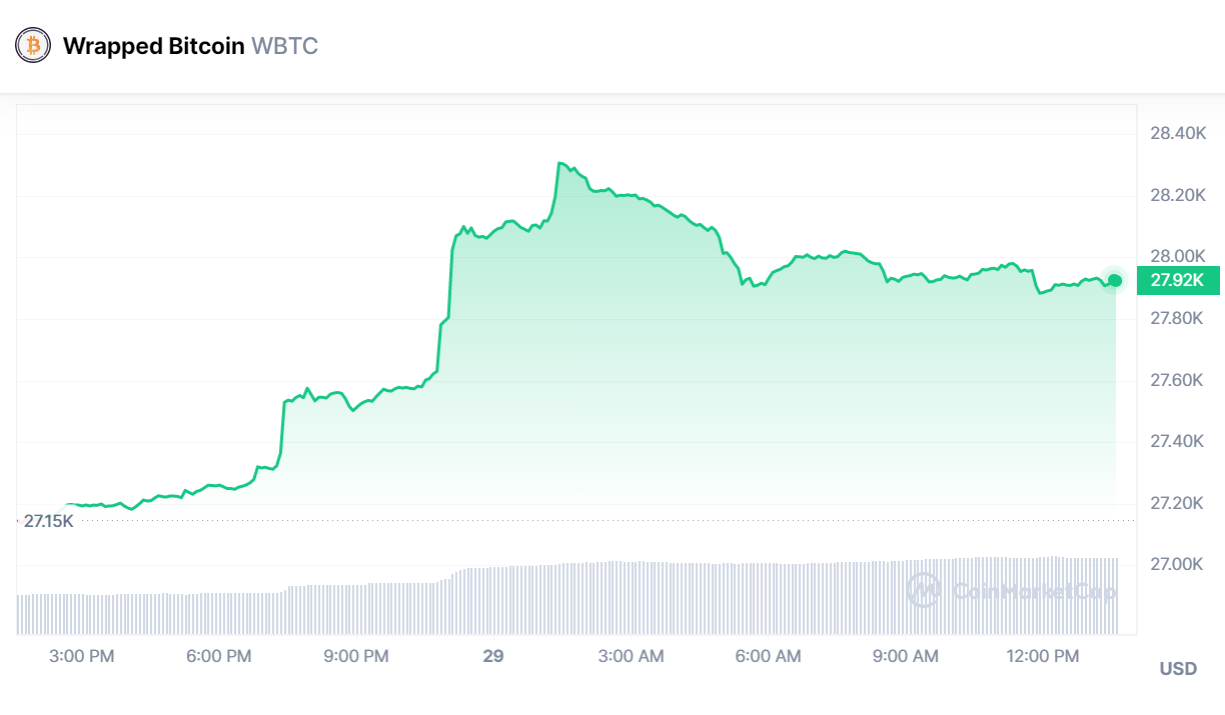

7. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin is a prominent token in decentralised finance (DeFi). It seeks to bridge the gap between Bitcoin, the largest cryptocurrency by market capitalisation, and the Ethereum blockchain. It enables Bitcoin holders to access the various services offered on Ethereum while maintaining exposure to the value of Bitcoin. WBTC combines the stability and widespread adoption of Bitcoin with the flexibility and programmability of Ethereum. This hybrid composition opens new possibilities for decentralised applications (dApps) and financial instruments.

Very exciting to see WBTC listed on @Okcoin! https://t.co/k4LO5ve3LL

— WBTC (@WrappedBTC) September 9, 2021

Since its launch in January 2019, WBTC has gained significant traction within the DeFi ecosystem. The token is created by depositing Bitcoin into a custodial service. Here, an equivalent amount of WBTC is minted on the Ethereum blockchain. This process is overseen by well-known custodians, including BitGo, CoinList, and Kyber Network, which hold the Bitcoin reserves backing WBTC. The custodians undergo regular audits to ensure transparency and handle underlying Bitcoin assets properly.

The total supply of WBTC has been steadily increasing, reaching significant milestones. The whole collection of WBTC has surpassed 150,000 tokens, representing a substantial increase from its early days. This growth reflects the growing demand for a tokenised representation of Bitcoin on the Ethereum network.

Furthermore, WBTC has become an integral part of the DeFi landscape. It is a liquidity source and collateral for various decentralised lending and borrowing platforms. By wrapping Bitcoin, users can access lending protocols like Aave, Compound, and MakerDAO. They can earn interest on their WBTC holdings or use WBTC as collateral to borrow other assets. This integration between WBTC and DeFi platforms has significantly expanded the utility and accessibility of Bitcoin within the Ethereum ecosystem.

Moreover, WBTC has also gained popularity as a trading pair on decentralised exchanges (DEXs) such as Uniswap and SushiSwap. Traders can easily swap between WBTC and other Ethereum-based tokens, enabling seamless liquidity between Bitcoin and other cryptocurrencies. This detail further enhances the interoperability and efficiency of the decentralised finance ecosystem.

The success of WBTC has led to the emergence of similar tokenised versions of Bitcoin on other blockchains. These iterations aim to replicate the functionality and liquidity WBTC provides. However, Wrapped Bitcoin remains the most widely adopted and recognised tokenised Bitcoin on the Ethereum network. It is the best crypto to buy now.

8. Fantom (FTM)

Fantom is a blockchain platform that provides fast, scalable, and secure smart contract functionality. Since its launch in 2018, Fantom has gained significant traction and has made notable progress in blockchain.

One of the key features of Fantom is its high throughput capability. The platform employs a directed acyclic graph (DAG) consensus mechanism called the Lachesis protocol. This mechanism enables fast transaction confirmation and scalability. With its robust architecture, Fantom aims to process thousands of transactions per second. This output makes it suitable for many applications and the best crypto to buy now.

The platform has successfully attracted several high-profile projects and collaborations, expanding its ecosystem. For instance, Fantom has partnered with Chainlink, a leading decentralised oracle network. The partnership enhances the security and reliability of data inputs for smart contracts. It would enable developers to access real-world data on the Fantom network securely.

Time: passes ⌛Transaction fees: paid ?FTM: burnt ?

10,000,000 $FTM has now been burned forever!

See for yourself: https://t.co/fsm6i3TaN5 pic.twitter.com/4BcHUS64f6

— Fantom Foundation (@FantomFDN) May 25, 2023

In addition to partnerships, Fantom has made strides in decentralised finance (DeFi). The platform hosts various DeFi applications, such as lending and borrowing protocols, decentralised exchanges, and yield farming platforms. The growing DeFi ecosystem on Fantom has been gaining attention from investors and traders. This development leads to increased liquidity and trading volume for native tokens.

Speaking of tokens, FTM is the native cryptocurrency of the Fantom network. FTM is the fuel for transactions and provides governance rights within the ecosystem. In recent months, the FTM token has experienced significant price appreciation, reflecting the growing interest in the Fantom platform. Check out FTM on eToro.

Furthermore, Fantom has been actively improving its infrastructure and developer tools. The platform offers a user-friendly interface, software development kits (SDKs), and APIs. These components make it easier for developers to build decentralised applications (dApps) on the Fantom network. This developer-centric approach fosters innovation and attracts more projects to leverage the platform’s capabilities.

9. Monero (XMR)

Monero is a privacy-focused cryptocurrency that was launched in April 2014. Since its inception, Monero has gained popularity for its strong emphasis on user privacy and anonymity. It utilises advanced cryptographic techniques to obfuscate transaction details, making tracing transactions and identifying involved parties nearly impossible.

Congratulations on a successful network upgrade! ? #Monero is now more private and efficient with ringsize 16, Bulletproofs+, and view tags!

Make sure your node/wallet is updated to continue using Monero.

Privacy and fungibility matter, and it’s exciting to keep improving!

— Monero (XMR) (@monero) August 13, 2022

A notable feature of Monero is its ring signature technology, which combines multiple transactions into a single transaction. This configuration makes it difficult to determine the true origin of funds. Additionally, Monero employs stealth addresses, which generate unique one-time addresses for each transaction. Therefore, they ensure that recipient addresses cannot be linked to the sender.

In recent years, Monero has witnessed significant developments aimed at improving its functionality and scalability. One notable upgrade is the implementation of Bulletproofs in October 2018, which reduced transaction sizes and fees while enhancing privacy. This upgrade was followed by the implementation of RandomX in November 2019. It was a new mining algorithm designed to resist the development of specialised mining hardware. RandomX promoted a fairer and more decentralised network.

Monero has also been actively involved in research and development to address potential privacy vulnerabilities. In January 2020, the Monero Research Lab released Triptych, a new technique that enhances the confidentiality of ring signatures. Furthermore, Monero has explored solutions to improve its scalability and reduce transaction fees through implementing technologies like Mimblewimble and Tari.

The cryptocurrency has enjoyed steady growth in market capitalisation and adoption. Monero ranks among the top 25 cryptocurrencies by market capitalisation, with a strong and dedicated community of users and developers. The total supply of Monero is limited to approximately 18.3 million coins. Its regular block rewards reduce over time through its emission schedule.

The privacy-centric nature of Monero has attracted a diverse range of users. It is often favoured by individuals who value financial privacy, such as activists, businesses, and individuals in jurisdictions with strict capital controls. Additionally, Monero has gained popularity among those seeking to protect their wealth and financial transactions from surveillance.

Monero has also seen increased acceptance as a means of exchange. Numerous online merchants and service providers have begun accepting XMR as payment. This adoption is because they recognise the value of privacy in the digital economy. Furthermore, Monero has gained support on various cryptocurrency exchanges, making it easily accessible to users worldwide.

10. Lido DAO (LDO)

Here is a decentralised autonomous organisation that aims to bring liquidity and accessibility to staked assets on various blockchains, primarily focusing on Ethereum 2.0. Lido allows users to stake Ethereum tokens and earn rewards while maintaining liquidity. It ensures that participants can actively participate in the Ethereum ecosystem without sacrificing the ability to access their funds.

In addition to Ethereum 2.0, Lido has expanded its services to other blockchain networks, including Terra and Solana. This expansion allows users to stake their tokens on multiple networks and earn rewards while benefiting from Lido’s liquidity. Lido enhances its role as a cross-chain liquidity provider by supporting various networks.

Furthermore, Lido DAO has made notable strides in governance and community involvement. Tokenholders can propose and vote on various protocol changes, upgrades, and parameters. This decentralised governance model ensures that the community has a say in the direction and evolution of Lido DAO. Additionally, Lido has been actively engaging its community through various initiatives, including grants programs and community-driven campaigns. These efforts foster a vibrant and engaged ecosystem around Lido DAO.

Following a successful on-chain vote, Lido V2 is officially here.https://t.co/36EmuagToD

?️ pic.twitter.com/sl4kjNpUYw

— Lido (@LidoFinance) May 15, 2023

Regarding statistics, Lido DAO has witnessed impressive growth in recent times. Lido’s staking protocols have steadily increased the total value locked (TVL). The TVL in Lido DAO exceeds several billion dollars ($12.755 billion), showcasing its significance within the decentralised finance ecosystem.

Lido’s native token, LDO, plays a vital role in the governance and utility of the platform. Holders of LDO have the power to vote on proposals and decisions, shaping the future of Lido DAO. The token has also gained attention from investors and traders due to its potential for value appreciation. LDO has been listed on major cryptocurrency exchanges, providing liquidity and accessibility for token holders.

Moreover, Lido DAO has been actively partnering and collaborating with other projects in the blockchain space. These partnerships aim to enhance the interoperability and scalability of Lido’s services, further expanding the options available to users. By joining forces with other prominent players in the industry, Lido DAO proves it is the best crypto to buy now. The collaborations strengthen its position as a leading staking services and liquidity solutions provider.

Read More

Wall Street Memes – Next Big Crypto

Early Access Presale Live Now

Established Community of Stocks & Crypto Traders

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Best Crypto to Buy Now In Meme Coin Sector

Team Behind OpenSea NFT Collection – Wall St Bulls

Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

[ad_2]

Source link